Introduction

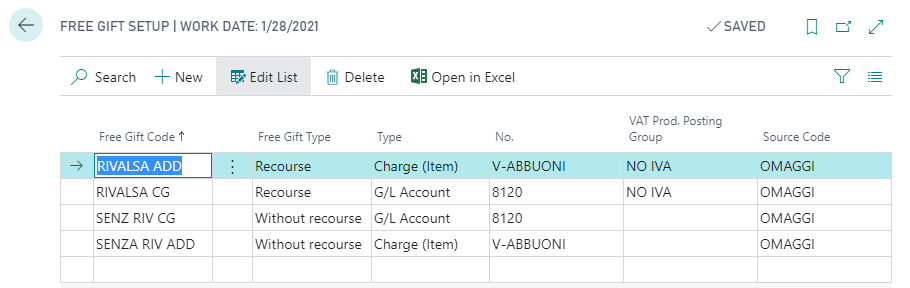

You can define the specific rules on the page Free Gifts Setup (SFG):

| Field | Description |

| Free Gift Code | Specifies the code that identifies this setup line |

| Free Gift Type |

choose between:

|

| Type |

choose between:

|

| No. | select the Charge (Item) No. or the Account No. according to the option in the field Type |

| VAT Prod. Posting Group |

If the Free Gift Type is

Without recourse the system allows the user to

choose the VAT Prod. Posting Group. If the field

VAT Prod. Posting Group is empty the system automatically will calculate it

according to the line item to which it relates. When releasing the order, where the " Charge Item" line has been created, the system verifies that the Line Amount Incl. VAT " (the sum of the 2 lines) is zero. If the Free Gift Type is With recourse the system allows the user to choose the VAT Prod. Posting Group (the Group will be with no VAT applied) |

| Source Code | Code that allows to distinguish the free gifts postings, so that they are easily identifiable. |

| N.B. |

The free gift managed with the

Item Charge must be accounted for in a specific account of the

free gifts. The system will then inherit the General Product

Posting Group set on item charge if populated:  If the Item Charge setup is not specified, then the free gift will inherit the General Product Posting Group on the source item line. |

| See also: |

| Introduction |

| Gifts with / without VAT recourse |