Free Gifts with VAT recourse

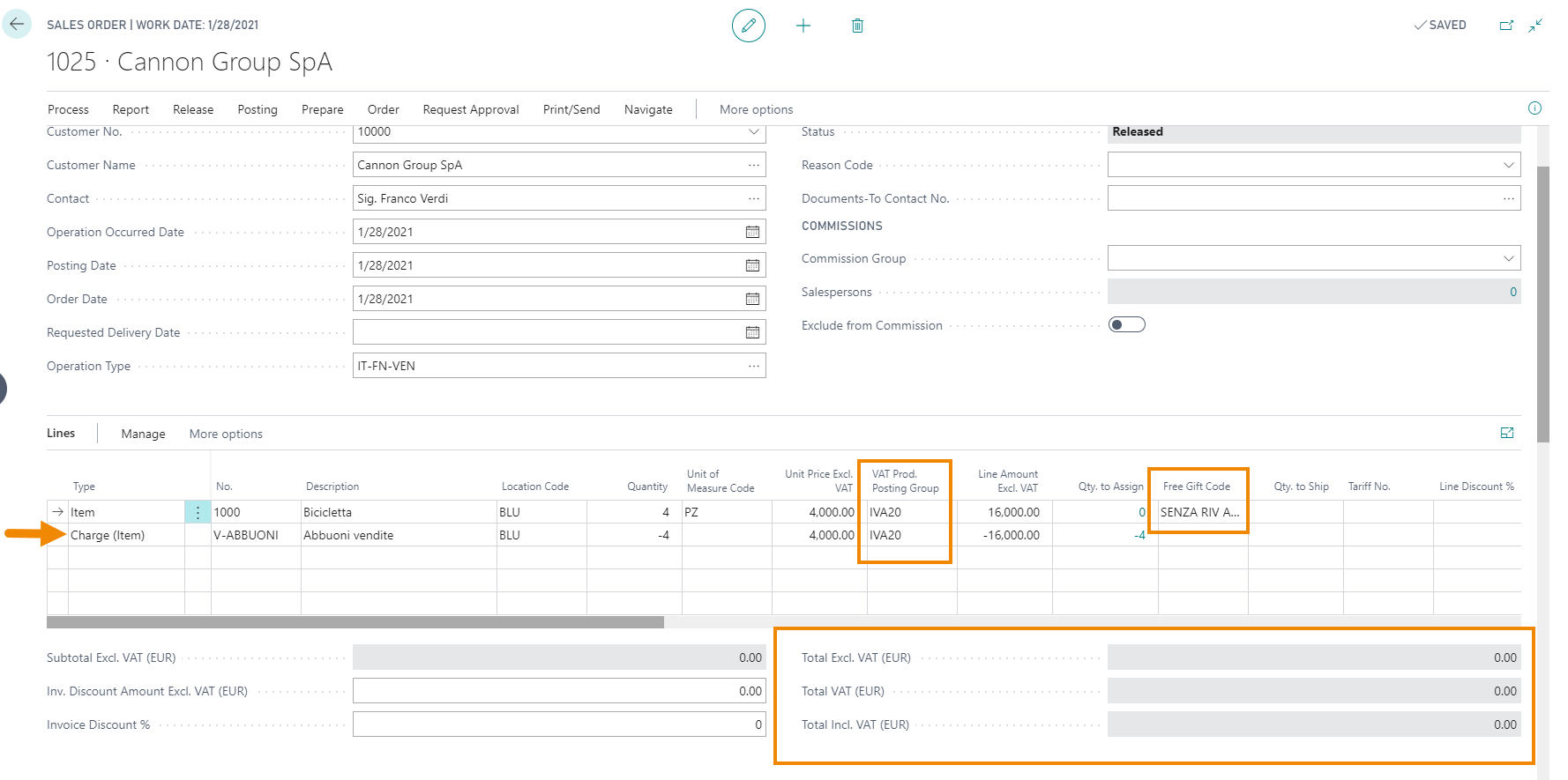

We create a sales order with a line type "Item".

For the item we choose Recourse as Free Gift Type:

Releasing the system creates a second reverse line with equal quantity and amount, but of opposite sign and different VAT Prod. Posting Group:

The order total is the VAT, which will be paid by the customer.

|

|---|

|

If you select a Free Gift Type with recourse the VAT Product Posting Group will be different from the source item line, because the line must show the VAT amount |

Free Gifts without VAT recourse

We create a sales order with a line type "Item".

For the item we choose Without recourse as Free Gift Type and with item charge:

Releasing the system will create a second reverse line with equal quatity and amount, but with opposite sign. The VAT Product Posting Group is the same.

The document total is zero.

|

|---|

|

If you select a Free Gift Type without recourse the VAT Product Posting Group will be equal to the source item line, because the total must be zero. |

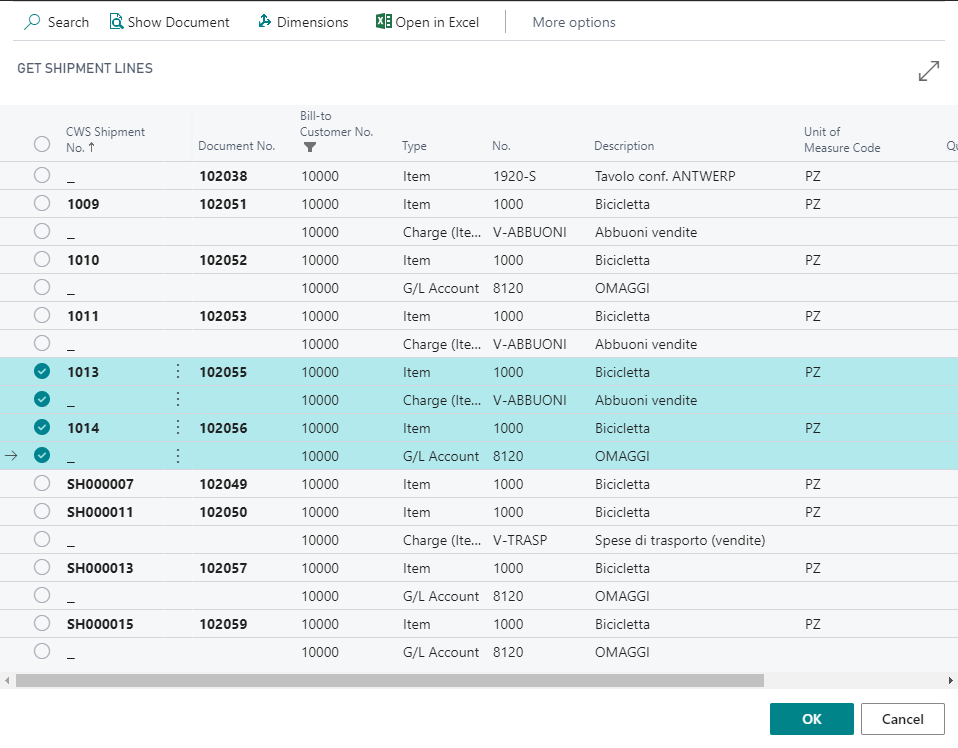

Invoicing

After posting the shipments related to the two created orders, we generate the invoice. We open a NEW document and from Line-> Functions-> Get shipment lines we choose the shipments:

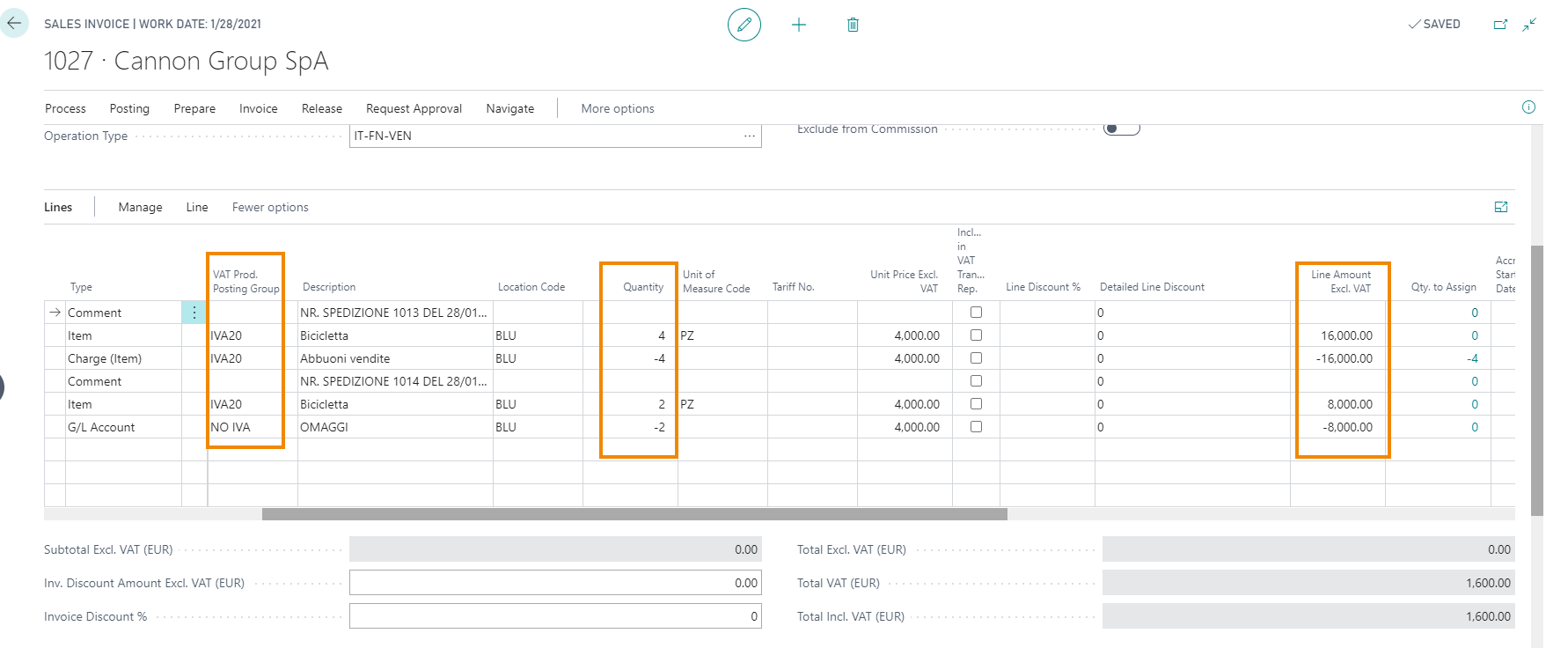

For each shipment the amounts and quantities must be zero:

-

The VAT is zero for the first shipment.

-

In the second the amount of VAT is equal to 1600 euro, which is the invoice total.

|

|---|

|

Ithe operation is the same also posting the Invoice directly from the Order or by using the cumulative invoicing. |

| See also: |

| Introduction |

| Setup |