Quick Guide

- Create the specific setup

- Create the invoice with or without VAT recourse

Introduction

The Sales Free Goods (SFG) Eos Solutions app allows, through fast setup, to manage the invoicing for free gifts with or without VAT recourse.

The free assignment of goods constitutes a relevant operation for VAT purposes, with obligation to issue the invoice with VAT. The customer who receives the free gift will be required to pay the tax only in the case of a "free assignment with operation of the VAT compensation." However, the company making the free sale may also decide not to recover any amounts paid of VAT, not charging it to the customer.

Depending on the solution chosen we can issue invoices with or without VAT recourse:

1. Invoice with VAT recourse : if we decide to make the customer pay the tax , we create a normal invoice and cancel the taxable amount, while VAT will be valued on the invoice.

2. Invoice without VAT recourse: in this case the invoice total will be zero because the goods are a free gift and VAT will be charged to us. We will have to record the operation in the register of free gifts with the percentage of applied VAT.

Subscription |

|---|

|

Some features of the Sales Free Goods (SFG) app require a subscription. The subscription can be activated from Subscription control panel or directly from the notification messages that the system proposes, by clicking on the link that allows you to start the subscription wizard. See Eos Solutions website for more information . |

Sales Free Goods (SFG) - SUMMARY

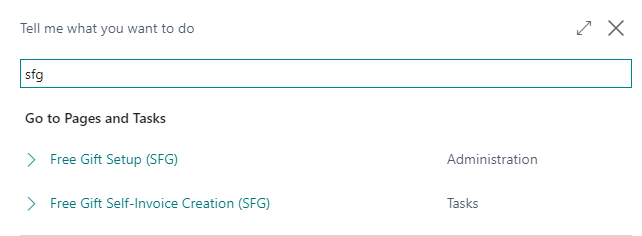

Press ALT + Q and digit "SFG" for a summary of the functionalities:

| Task | Vedere |

| Set the specific options | Setup |

| Create order and the sales free invoice | Gifts with / without VAT recourse |

| Generate the self-invoice relating to gifts | Free Gift Self-Invoice |