Quick guide

- Create a self-billing customer in Customer list

- Set self-billing report

- Print a self-billing invoice/credit memo

Introduction

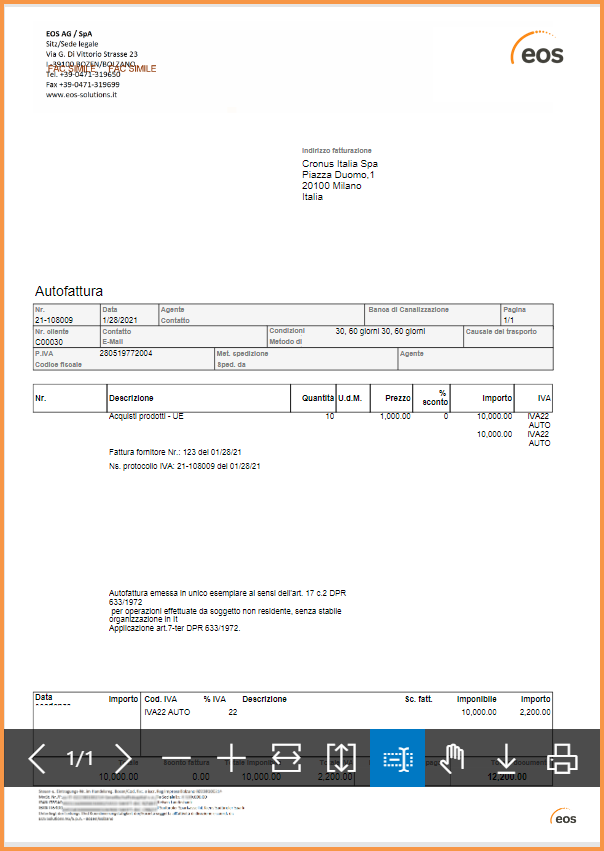

The selfbilling regulates the purchase of goods and services from non-residents based on the art. 17, paragraph 2, D.P.R. 633/72 - Dir 2006/112 / CE, art. 196.

The Italian operator,VAT subject, who purchases goods or services from an operator (not from a private individual) who is not resident in Italy, must normally issue a self-billed invoice if the operation takes place in Italy. It is therefore necessary to establish where the assignment or service is deemed to have been made for VAT purposes. The obligation to issue a self-billing invoice excludes intra- UE community purchases of goods and purchases of generic services from EU operators, for which the invoice received must be integrated.

Subscription |

|---|

|

Some features of the Self Billing For Italy App require a subscription. The subscription can be activated from Subscription control panel or directly from the notification messages that the system proposes, by clicking on the link that allows you to start the subscription wizard. For more information visit Eos Solutions.

|

Note |

|---|

|

Starting from 01/01/21, the technical notes regarding the new "tracciato 1.6", concerning electronic invoicing, have introduced the use of specific Document Types, aimed at sending to the SDI electronic documents, related to the internal and external reverse charge (self-billing) and integrations. For the management of electronic invoices / integrations, please refer to the specific App Electronic Invoice for Italy - FTE. |

Self Billing For Italy - SUMMARY

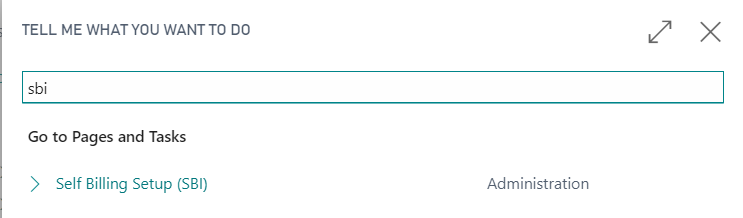

Press ALT + Q and digit "SBI" for a summary of the involved functionalities:

Self Billing

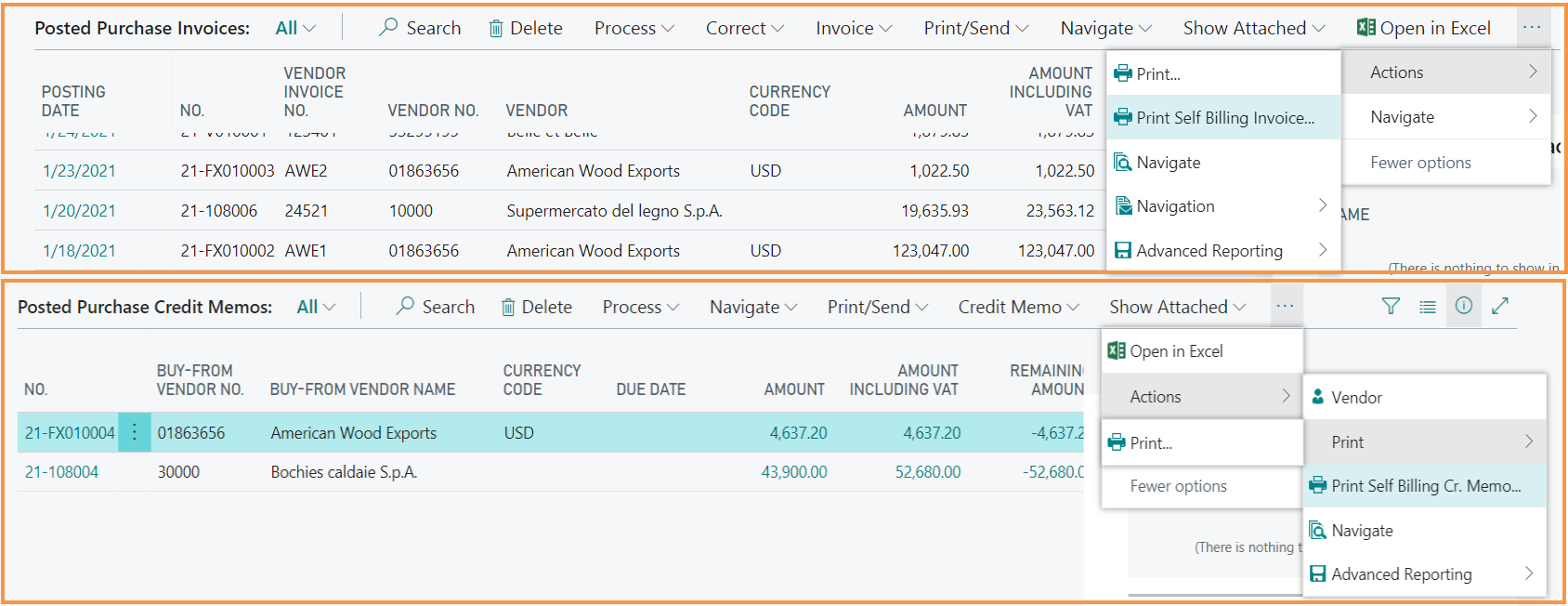

The Self Billing For Italy app allows you to print a self-invoice/credit memo from Posted Purchase Invoice/Posted Purchase Credit Memos:

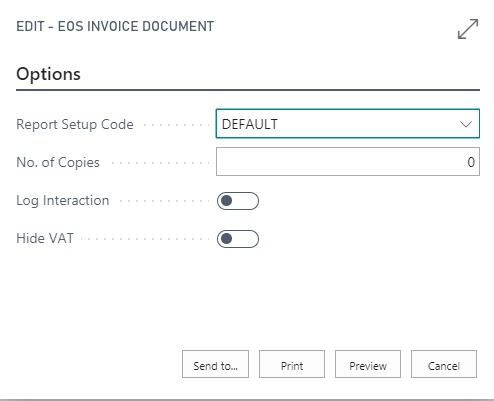

It is possible to select a specific report, how many copies to print, whether to hide the VAT, whether to enable the posting of the interaction entry:

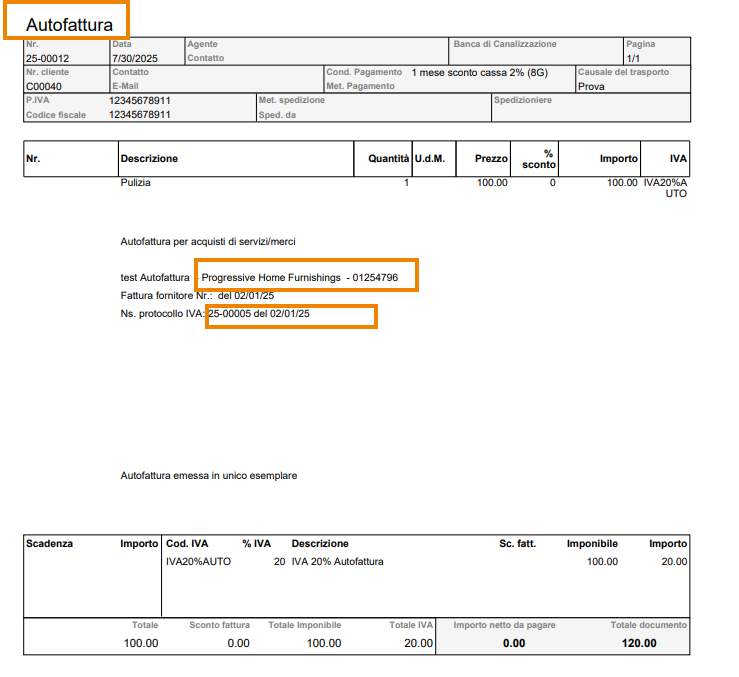

Print example:

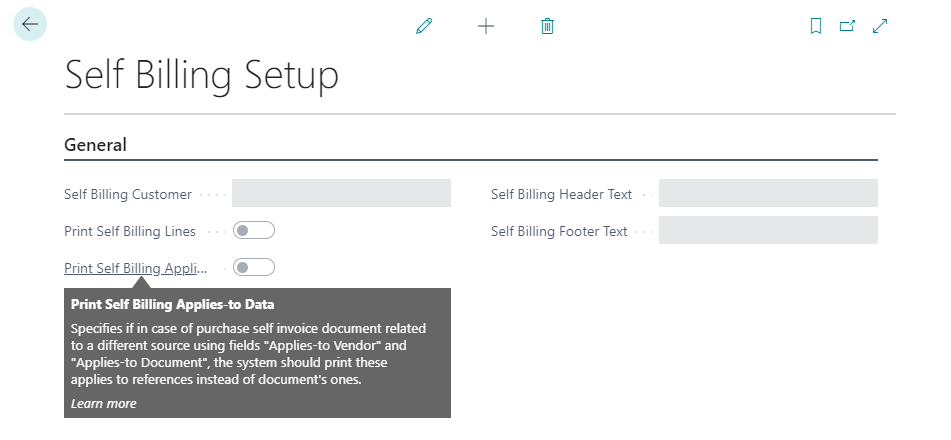

Self Billing Setup

In Self Billing Setup the Self Billing Customer must be indicated. This customer is the billing account holder. Therefore, a new customer with company data must be set in the customer list.

| Field | Description |

| Self Billing Customer | Select the specific customer created in the Customer list |

| Print Self Billing Lines | Choose whether to print the VAT lines |

| Self Billing Header text / Self Billing Footer Text | It is possible to insert a free text (extended texts) for the lines and for the footer |

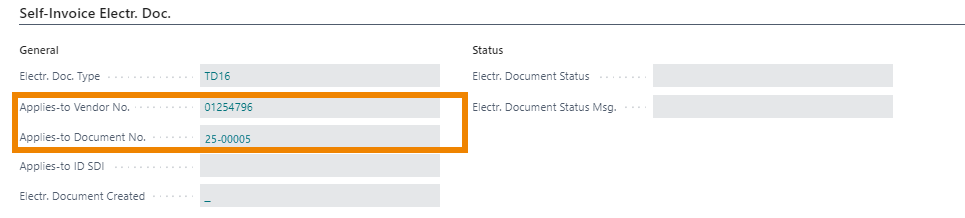

| Print Self Billing Applies-to Data |

Specifies if in case of purchase self invoice document related to a different source

specified in fields "Applies-to Vendor" and "Applies-to Document" the system should print these applies to references instead of document's ones.  |

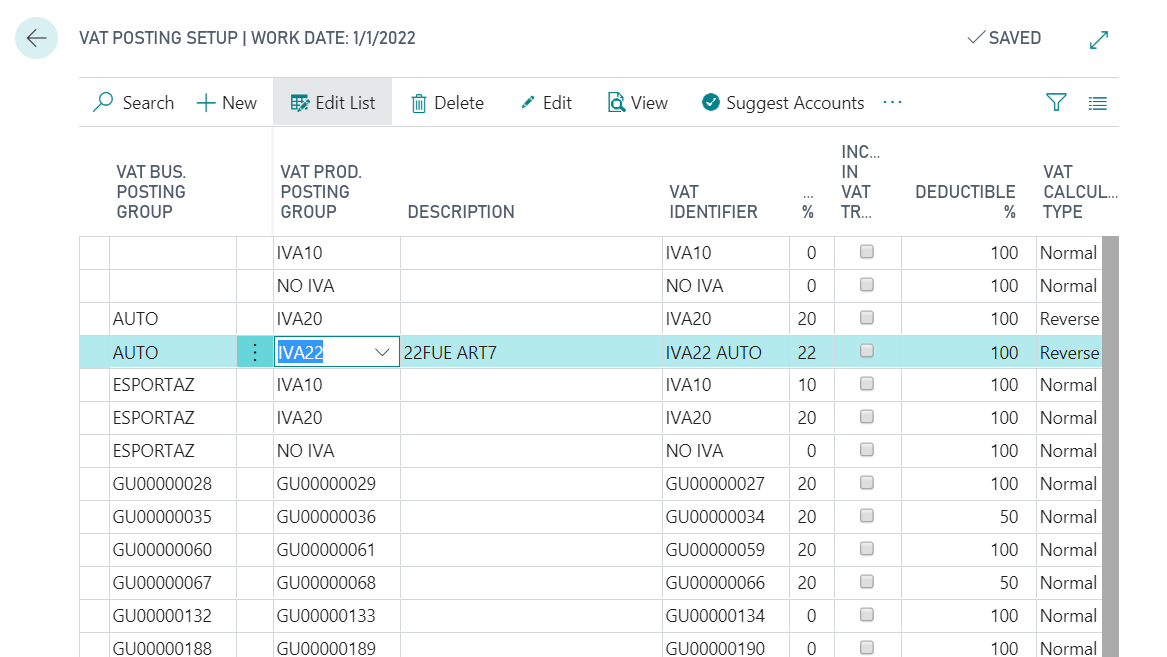

VAT Posting Setup

For a correct printing of the self billing invoice, it is necessary that the VAT posting setup for the purchase invoices is the same as the one set for the purchase invoices that provide for the integration on sale (eg Purchases of goods or EU services or Reverse charge). As an example we see a case of purchase of non-EU services.

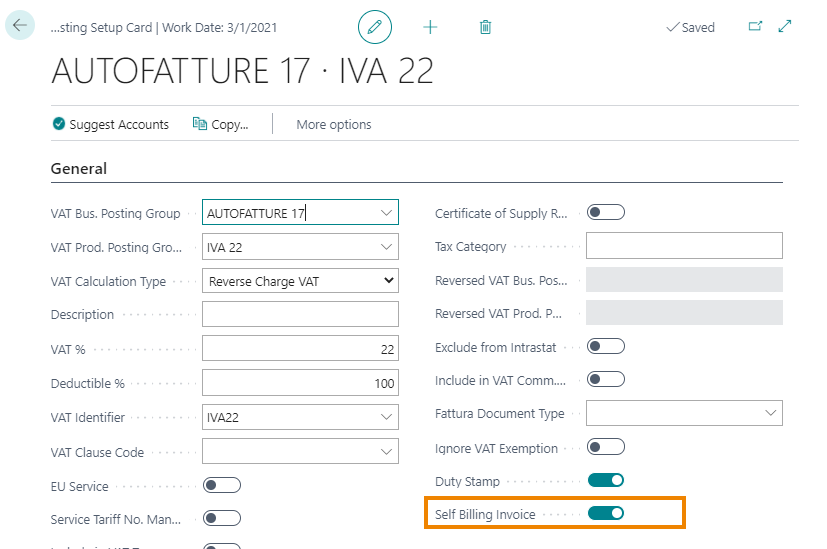

In the VAT registration setup a special line must be set in which the VAT type is "Reverse Charge VAT". For this Vat Bus. Posting Group the option "Self Billing" must be enabled:

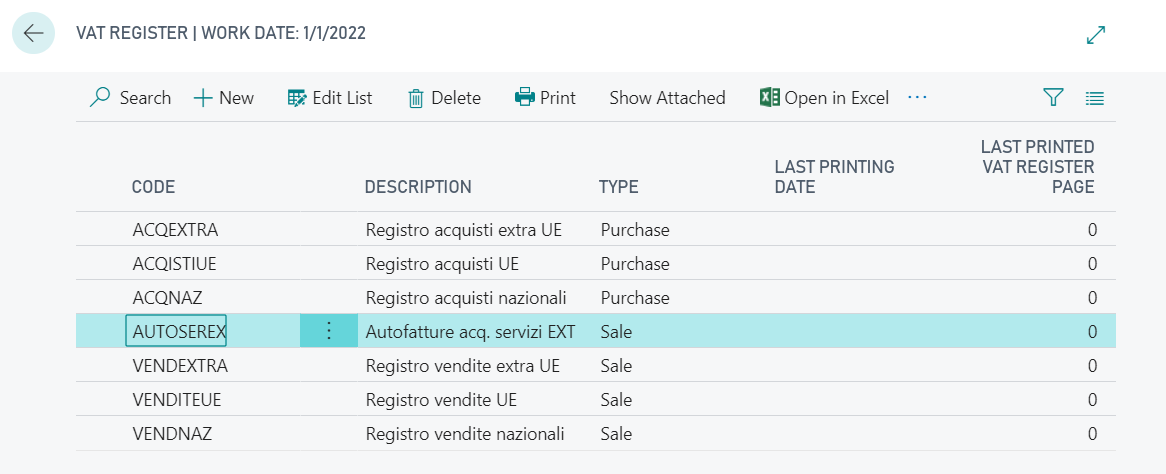

A special register must be created in VAT Register:

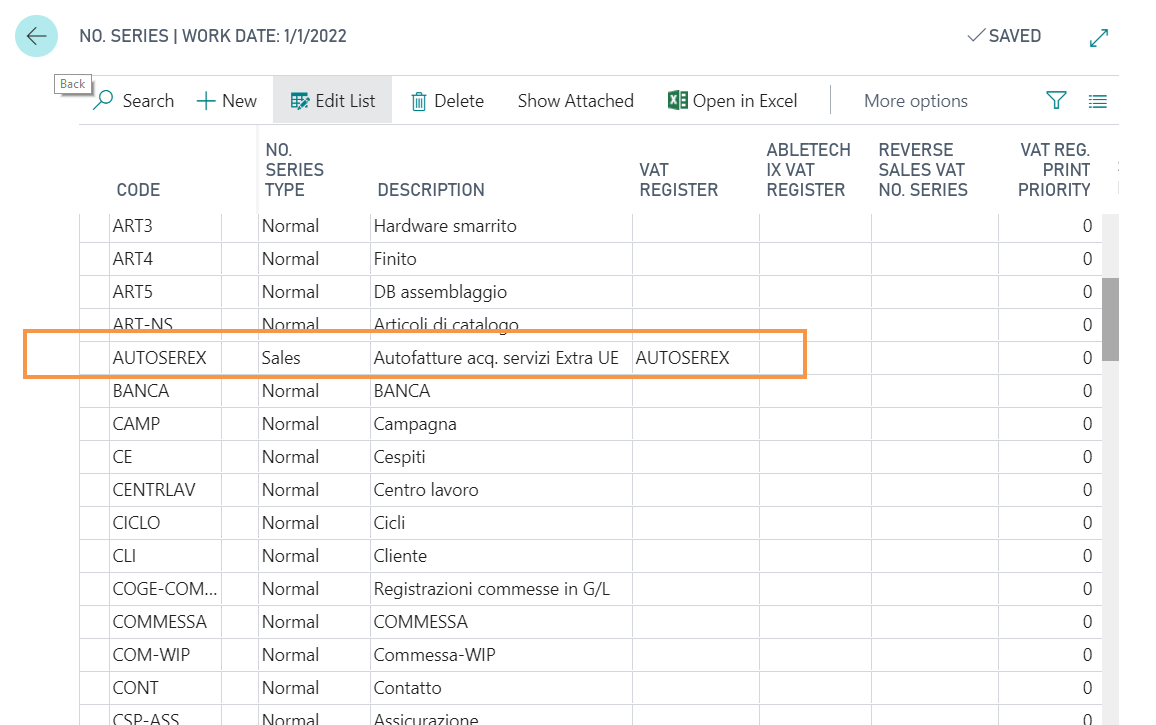

The relative No. Series is then created, linked to the VAT register:

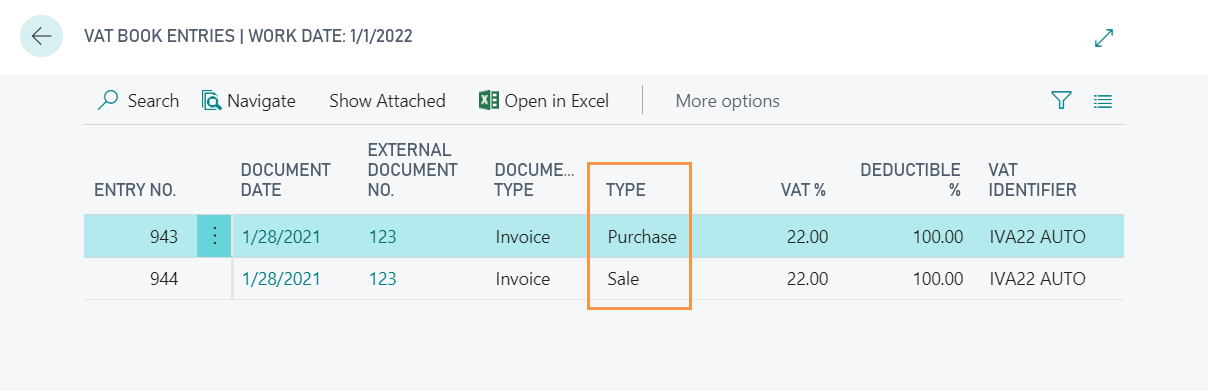

During the posting of the purchase invoice, with the setup previously exposed, the system will also create the relative sales movement on the VAT book entries:

|

|---|

|

The report used is the one defined in "Setup report" -> "Posted Sales Invoices". |