From April 2015 the obligation of electronic invoicing to the Public Administration (PA invoice) has entered into force; from January 2017 the one between Private (B2B invoice) has taken off. From January 2019 electronic invoicing towards companies and individuals becomes mandatory (already from July, for companies operating in the field of the sale of gasoline and diesel and for subcontractors PA) (Budget Law 2018). Let’s see the procedure: The Eos Solutions Electronic invoice for Italy App allows you to execute the e-invoicing process by managing:

| Subscription |

| Some features of the Electronic Invoice for Italy App require a subscription. The subscription can be activated from Subscription control panel or directly from the notification messages that the system proposes, by clicking on the link that allows you to start the subscription wizard. See Eos Solutions website for more information. |

Electronic Invoice for Italy - SUMMARY

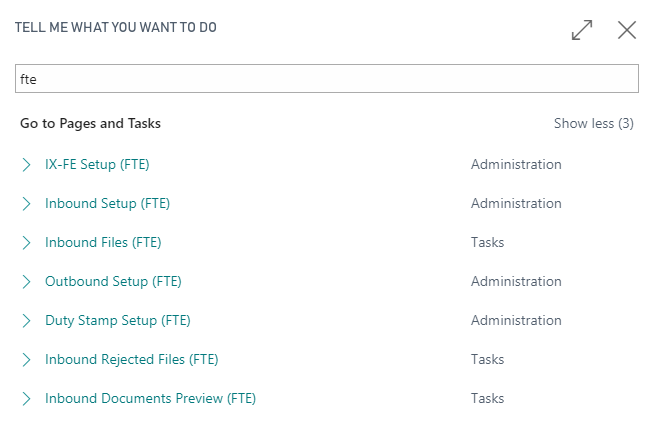

For a summary of the functionalities involved, press ALT + Q and type "FTE":

| Task | See |

| Perform the setup for electronic invoicing | Setup |

| Issue electronic invoices | Sales Invoices |

| Receive and process electronic documents | Purchase Invoices |

| Self-Invoice | Self-Invoice |

| Features of the exchange system | Intermediary IX |

| Monitor electronic document status | IX-FE Status |

| Differences between the PA invoice and the B2B invoice | PA vs B2B |

| Configure the parameters necessary to enable integration between EOS Platform and IX-FE | IX-FE Setup |

| How to make Split Payment | Split Payment |

| Frequently Asked Questions | FAQ |