VAT Plafond Periods (VMI)

Eos Vat Management for Italy app allows you to preview and check VAT Plafond overruns.

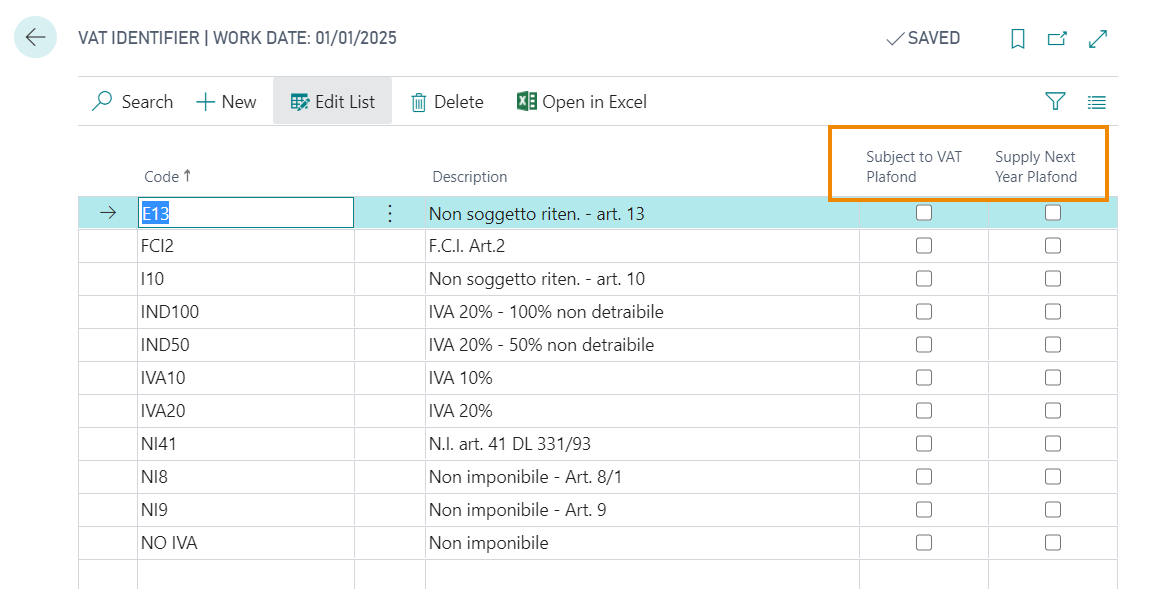

On page VAT Identifier you need to enter choose :

| Field | Description |

| Subject to VAT Plafond | Specifies if the VAT code is subject to a VAT exemption ceiling |

| Supply Next Year Plafond | It indicates which VAT codes are used to foreign sales. Necessary to calculate the ceiling of the following year, for regular exporters. |

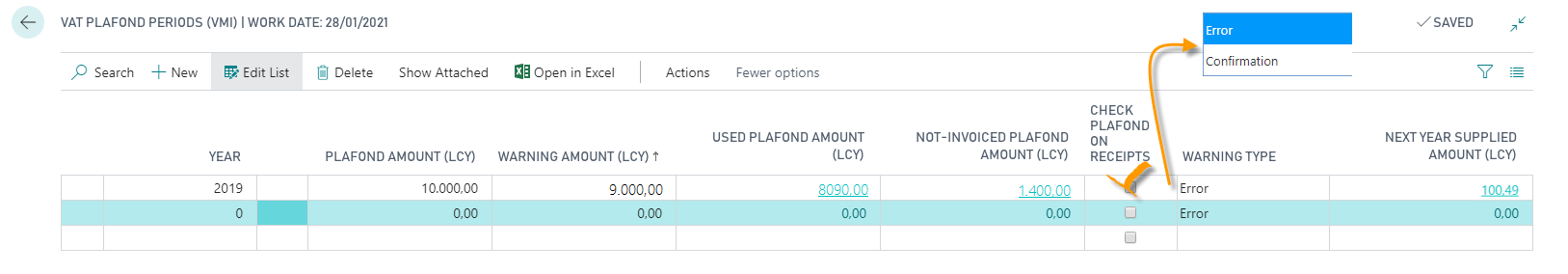

Open VAT Plafond Periods (VMI)

|

Field |

Description | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | The plafond is calculated for the year entered in this field | ||||||||||||||||||

| Plafond Amount (LCY) | Plafond amount for the current year | ||||||||||||||||||

| Warning Amount (LCY) | Amount beyond which the system must warn that the

plafond amount is ending.

Based on the setup on the line in the Warning Type field the system: - warns that you are passing the Plafond and asks for confirmation to continue - blocks the user |

||||||||||||||||||

| Used Plafond Amount (LCY) | Flowfield field that calculates the total of all the document entries with VAT exemption posted so far | ||||||||||||||||||

| Not-Invoiced Plafond Amount (LCY) | Flowfield field that calculates the total of all document entries with VAT exemption that still have to be invoiced | ||||||||||||||||||

| Check Plafond On Receipts | If enabled allows to calculate the plafond at the time of receipt | ||||||||||||||||||

| Warning Type | Option field that allows you to choose between:

"Error": once the limit defined by the plafond is exceeded (when the amount of purchase invoices with VAT exemption is greater than the amount of the plafond) the system no longer allows you to post invoices in exemption and blocks the user. "Confirm": once the limit defined by the plafond has been exceeded, the system provides you with a warning message that requires confirmation; if the user wants to proceed by posting invoices in exemption, he can do so.

N.B. The System cheks also the receipts if "Check Plafond On Receipts" field is enabled. |

||||||||||||||||||

| Next Year Supplied Amount (LCY) | Flowfield field that sums up the sales invoices issued abroad and not taxable, so as to automatically calculate the plafond for the following year |

VAT Plafond Summary (VMI)

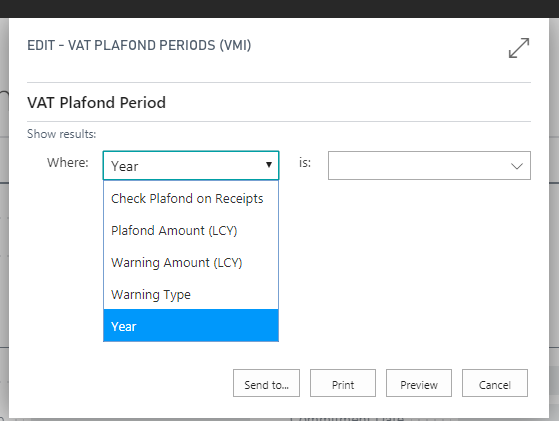

This page allows you to to print the information on VAT used and residual amounts filtering by

See also:

VAT Registers