For operations to be carried out from January 1st 2015, regular exporters wishing to buy or import without charging VAT must electronically transmit a declaration of intent (Dichiarazioni di Intento) to the tax authority (Agenzia delle Entrate) either directly, by persons authorized by Entratel or Fisconline, or by a third party. The declaration, together with the receipt from the authorities, is then delivered to the supplier or to the customs authorities (Decree No. 175/2014).

| Until 27th April 2020 | From 2nd March 2020 |

| Until 04 27 2020 | Modello 2020 |

Create VAT Exemption (VMI) - VENDOR SIDE

In order to create a vat exemption card for a Vendor, go to the Vendor List, press ALT + Q and digit "Vat". Choose "Vat Exemptions on current page". Select an Issue date and, if necessary, a specific protocol number. In the next page fill in the fields requested:

|

Field |

Description |

|---|---|

| Issue Date | In the declarations issued to vendors, it indicates precisely the date of issue of the declaration. In the declarations received from customers, the field is still proposed in the creation phase but, it indicates the generation date of the record in the table. |

| Receipt Date | To be filled in only in the declarations received from customers, with the date of the electronic receipt of the AdE (same date which is then exported in the electronic invoice) |

| VAT Bureau No. | Choose a number for the italian "Ufficio IVA" |

| VAT Prod. Posting Group | Select the correct VAT Group (with no VAT indicated) |

| Year | Indicates the year in which the declaration is valid. The system will automatically insert the Starting Date and the Ending Date . |

| Starting / Ending Date | Starting: field set automatically by the system if the Year field has been filled

in. The field can however be modified. Ending: field set automatically by the system if the Year field has been filled in. The field can however be modified. |

| Declaration Type |

Options:

|

| Amount (LCY) | To enter manually, if the Declaration Type is for "Amount" or "Transaction" |

| Used Amount (LCY) | it is possible to enter manually the amount already used. For example if the company starts managing the Vat Management App in the middle of the year and has already used some amount for the VAT Exemption |

| Used Amount (Total, LCY) | Shows the total amount (used amount + amount) already used |

| Revoked Date | fill in the revocation date if necessary |

| Plafond Type |

Indicate if it is

|

| Purchasing / Importation | Description of goods/services |

| Sending Protocol 1 / Sending Protocol 2 | It is mandatory to include the first (17CHR) and the second (6CHR) part of the protocol nr. assigned by the Tax Authority. If not entered, the system will return an error when generating xml files. |

| Integr. Sending Protocol 1 /

Integr. Sending Protocol 2 |

In case of data integration / correction for a declaration already submitted , the first (17CHR) and the second (6CHR) part of the protocol number assigned by the Tax Authority must be entered. |

| Annual VAT Statement Submitted | Enable the option if, on the date of transmission, the annual VAT statement has already been presented |

| Exports Intra-Community Services Services to San Marino Assimilated Operations |

These are the operations that contributed to the formation of the VAT plafond, if the annual VAT statement has not yet been presented. It is mandatory to enable at least one of the boxes. |

After entering all the requested fields you need to change the status of the Declaration.

From Process->Change Status:

| N.B. |

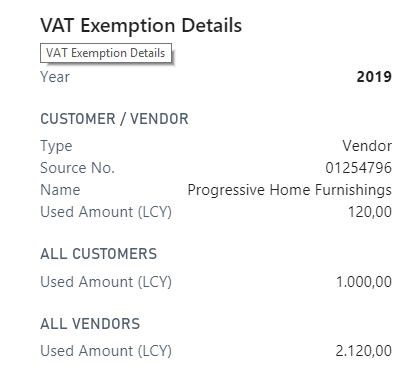

In the VAT Exemption List / Card a Factbox on the right shows

all the details of the exemptions: it shows the totals for all

Customer and all Vendors. |

When you create a Vendor invoice the system will consider VAT equal to zero.

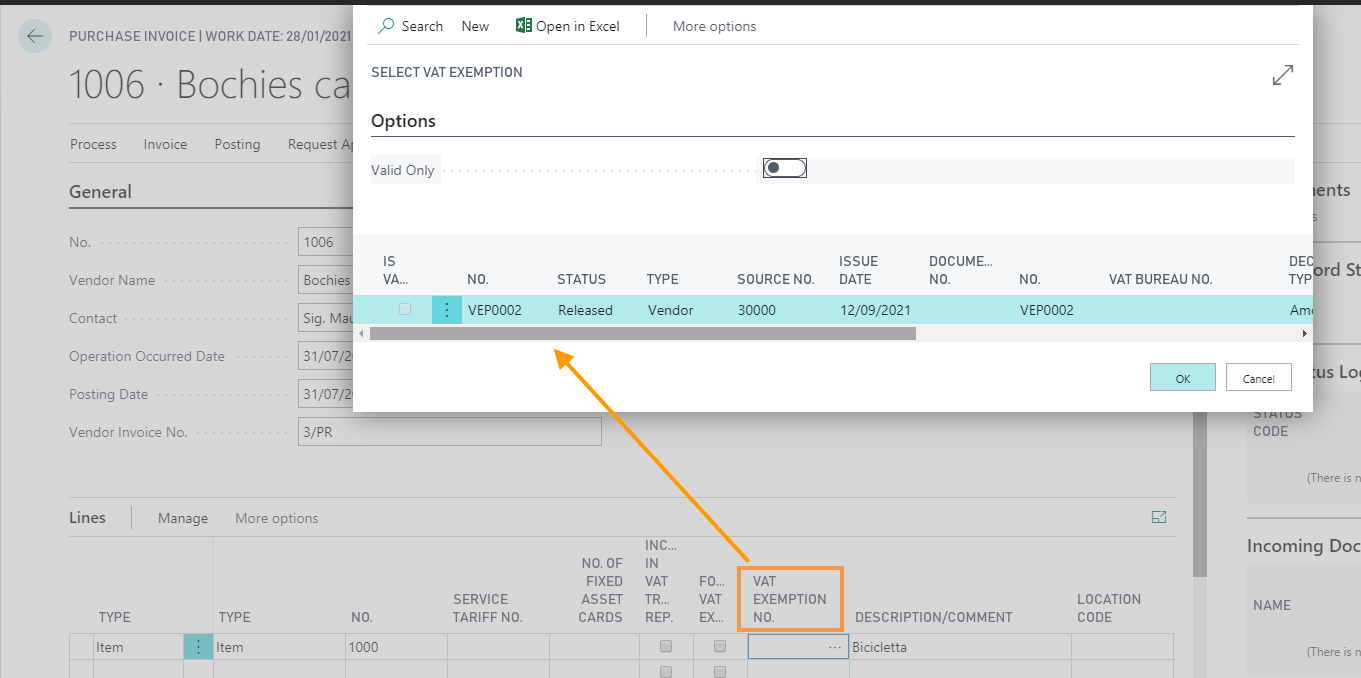

It is possible to enter an exemption valid for a single line filling in the "VAT Exemption No." field:

If there are multiple Declarations for the Vendor, the system automatically inserts the one with the earliest date.

| NOTE |

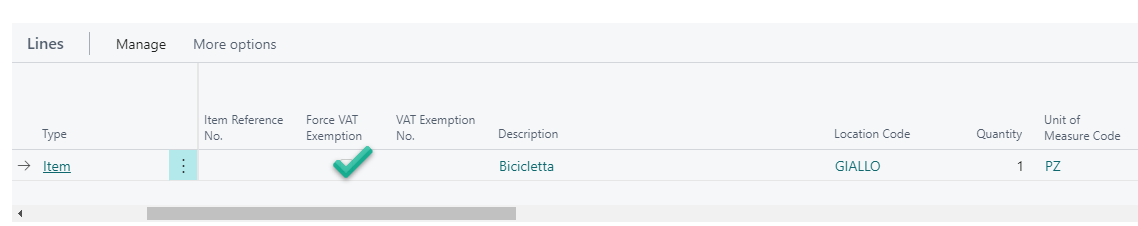

The option “Force VAT Exemption "on the lines is automatically crossed out by the system every time the

VAT Exemption data on the invoice do not match the original

VAT Exemption data on the shipment / receipt: |

Create VAT Exemption (VMI) - CUSTOMER SIDE

In order to create a vat exemption card for a Customer, go to the Customer List, press ALT + Q and digit "Vat". Choose "Vat Exemptions on current page". Select an Issue date and, if necessary, a specific protocol number. In the next page fill in the fields requested:

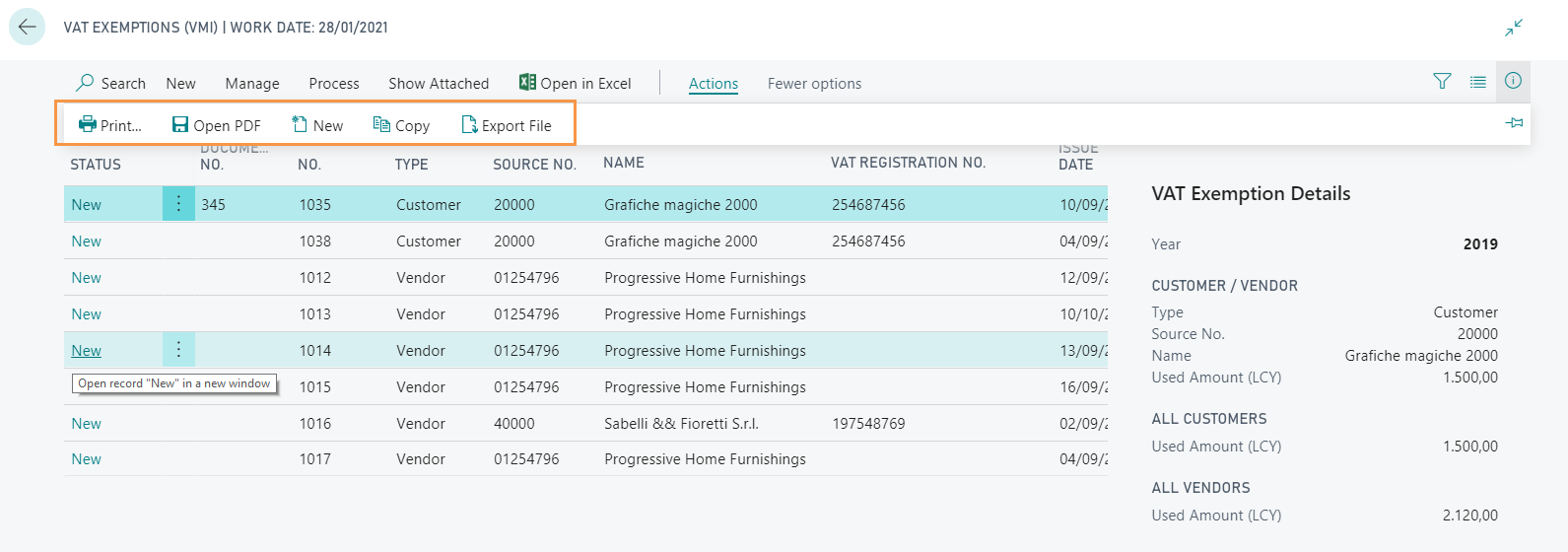

VAT Exemptions List (VMI)

|

Field |

Description |

|---|---|

| It is possible to print fields and values of the declaration according to the positions of the official layout. Choose the number of the declaration to be printed and the pages. (Useful, for example, to physically print on the official form provided by the Revenue Agency ). | |

| Open PDF | It is possible to open the declaration in a pdf file. In this case the layout of the .pdf file is the official one (it is already preloaded in the system). |

| New | Press New to enter a new line |

| Copy |

For instance, if you need to enter in the current year Declarations already entered for the previous year, it is possible to copy them without entering all the data.

In the Date Formula field, enter the period of time indicating how far the declaration is postponed . E.g. If I want a declaration valid for the period 1/09/2015-31/11/2015 to be valid for the same period of the year 2016, in the field Date formula I will insert 1A (= 1 year). |

| Export File | It is possible to select one or more declarations to be exported in .txt file format. If you export more than one declaration it is possible to choose wether to split them in various .txt files zipped. |

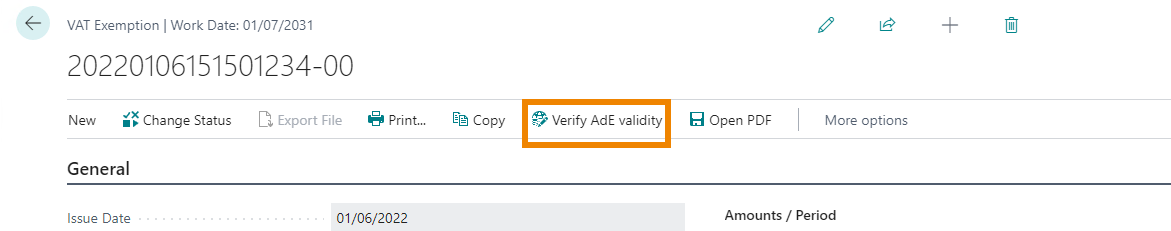

Verify AdE validity

Through "Verify AdE validity" it is possible to reach the appropriate web page of the Agenzia delle Entrate website to check whether the declaration has been properly submitted or not:

VAT Exemptions Setup (VMI)

In VAT Exemption Setup (VMI), General Tab, enter a sales and purchase protocol number.

In Fiscal Data Tab:

|

Field |

Description |

|---|---|

| Intermediary No. | Fill in the Intermediary number who transmits the declaration, if present |

| Tax Repres. Vendor No. | Indicates the tax representative signing the declaration, if different from the declarant |

| Appointment Code | usually 1, 6, 9  |

| Vendor Type |

Indicates the subject responsible for the electronic transmission Option values: 1 : subjects who send their own declaration 10 : CAF; companies belonging to a group, which send the declaration on behalf of the various companies of the group |

| Commitment Date | On this date the intermediary undertakes to transmit the declaration of intent |

In Signatures Tab enter the Signatures images.

See also:

VAT Registers