Quick Guide

- Set the "Withholding Tax Setup (ECU)"

- In "Withholding Tax" set the parameters which refer to the Communication to export

- Verify the preview and export the file

Introduzione

The Withholding Tax Certificazioni Uniche For Italy (ECU) Eos Solutions app allows you to process and send the file Certificazioni Uniche. It also allows you to print it on the official form provided by the Tax Authority.

The CU - Certificazione Unica is an annual declaration of all the income paid by the employer or the pension institution over a calendar year.

The tax document must certify employees and employment income, self-employment income, commissions and miscellaneous income. The CU report must be issued to the employees through the summary template by 31 March each year and then forwarded to the Revenue Agency through a specific model.

The Company or the Pension Institution send the document:

-

in paper format

-

through electronic transmission

Subscription |

|---|

|

Some features of the Withholding Tax Certificazioni Uniche For Italy (ECU) App require a subscription. The subscription can be activated from Subscription control panel or directly from the notification messages that the system proposes, by clicking on the link that allows you to start the subscription wizard. For more information visit Eos Solutions. |

Withholding Tax Certificazioni Uniche For Italy (ECU) - SUMMARY

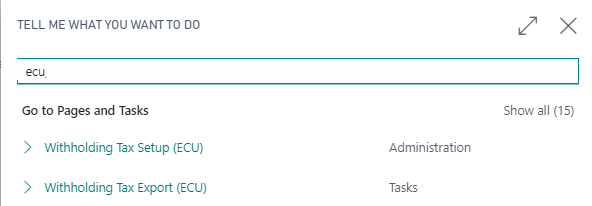

Press ALT + Q e digitare "ECU" for a summary of the features:

Withholding Tax Setup (ECU)

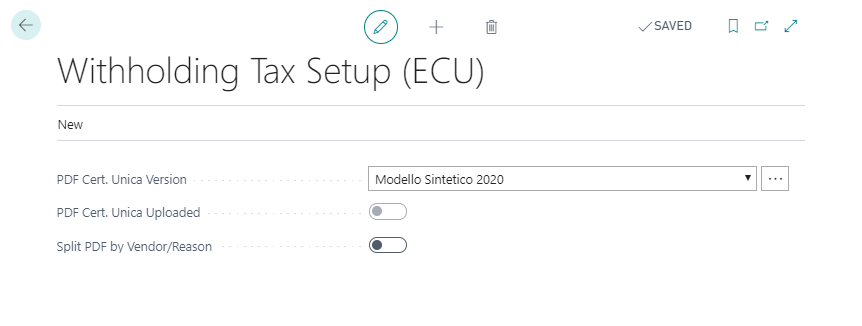

Nel Setup scegliere il layout ufficiale per la stampa tra quelli precaricati a sistema.

In the Setup page select the official layout for printing among those preloaded on the system.

| Field | Description |

| PDF Cert. Unica Version | choose the official form to be used (downloaded from the Cloud) |

| PDF Cert. Unica Uploaded | it is automatically activated by the system |

| Split PDF by Vendor/Reason | if enabled the pdf will be filtered by vendor |

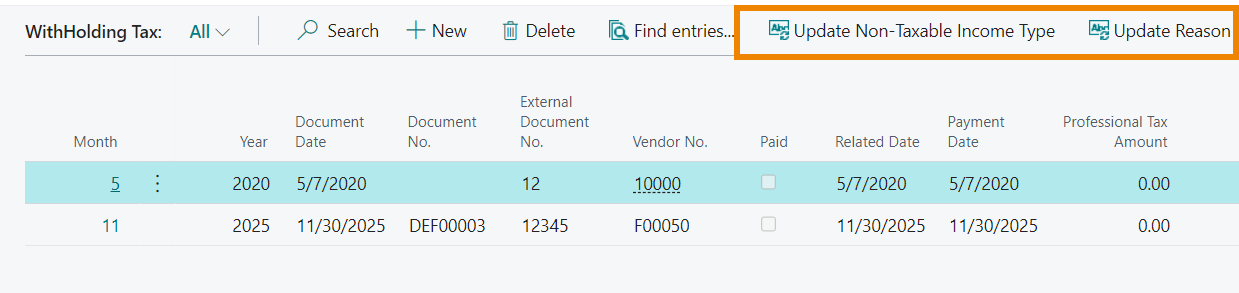

Massively update the "Non-Taxable Income Type" field and the "Reason" field

On page WithHolding Tax it is possible to massively update the "Non-Taxable Income Type" field and the "Reason" field:

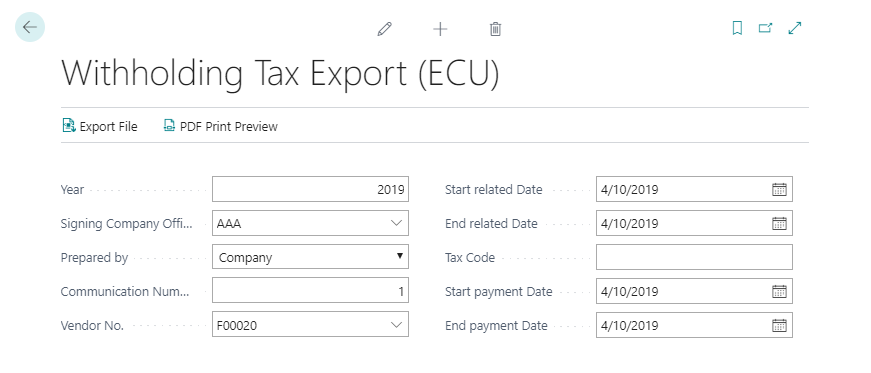

Withholding Tax Export (ECU)

Thanks to the Witholding Tax Certificazioni Uniche For Italy (ECU) app you can process and send the file Certificazioni Uniche printed on the official form:

| Field | Description |

| Year | write the year to which the Communication is referred |

| Signing Company Officials |

choose a Company official who can sign the Communication. N.B. In the General Ledger Setup you need to set a No. Series for Officials |

| Prepared by |

specifies the subject who submits the Communication:

|

| Communication Number | fill in the Communication number |

| Vendor No. | it is possible to filter by vendor |

| Start/ End related Date | indicate the competence period for the posted documents |

| Tax Code | specify the tax code |

| Start / End payment Date | it is possible to indicate the starting / ending date for the payments |

Pressing PDF Print Preview the system displays the data relating to the four sections of the form to be filled. The fields are the same as those found in the paper format.

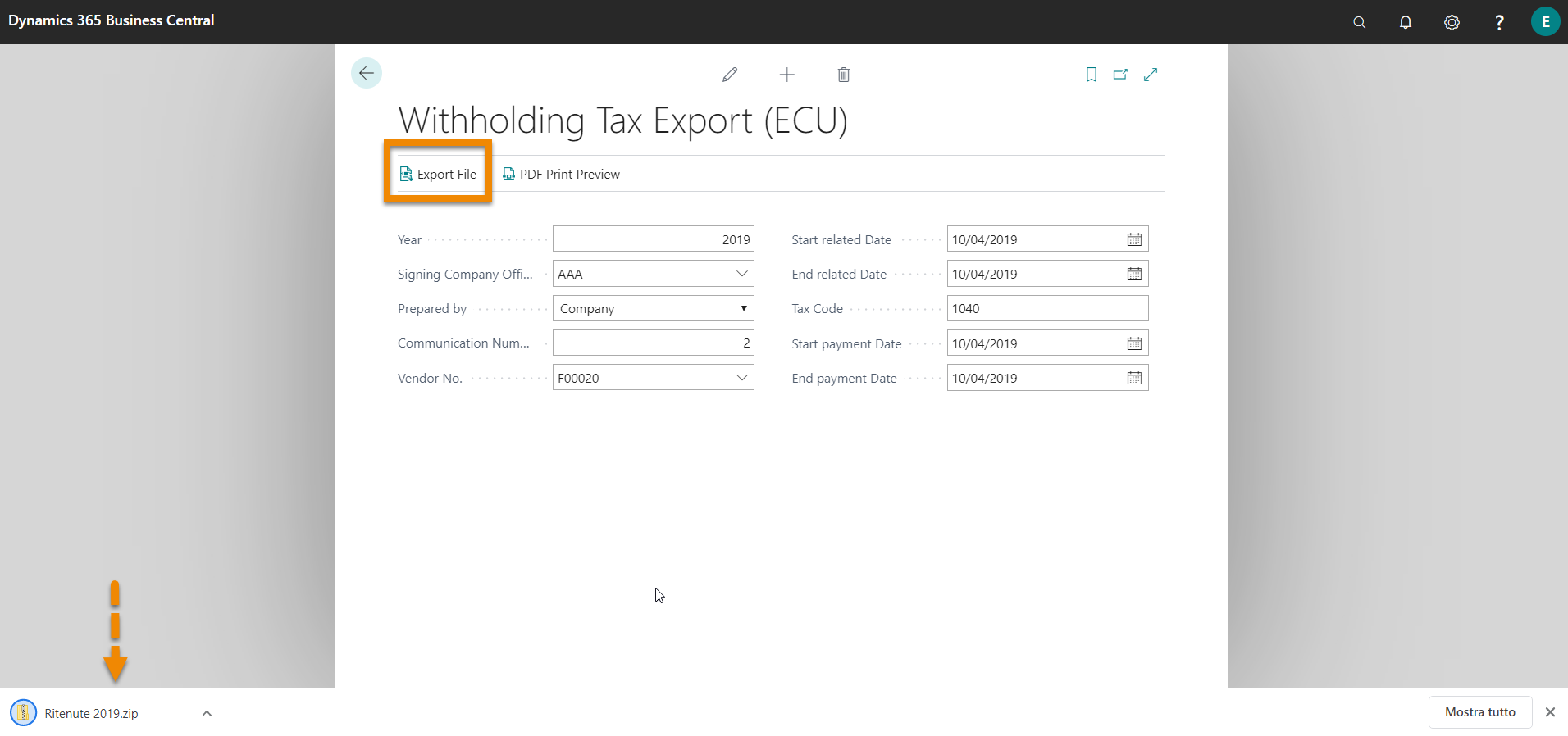

Pressing Export File the system will generate the file Ritenute YEAR.zip to send through electronic transmission:

Examples

Let's see some examples:

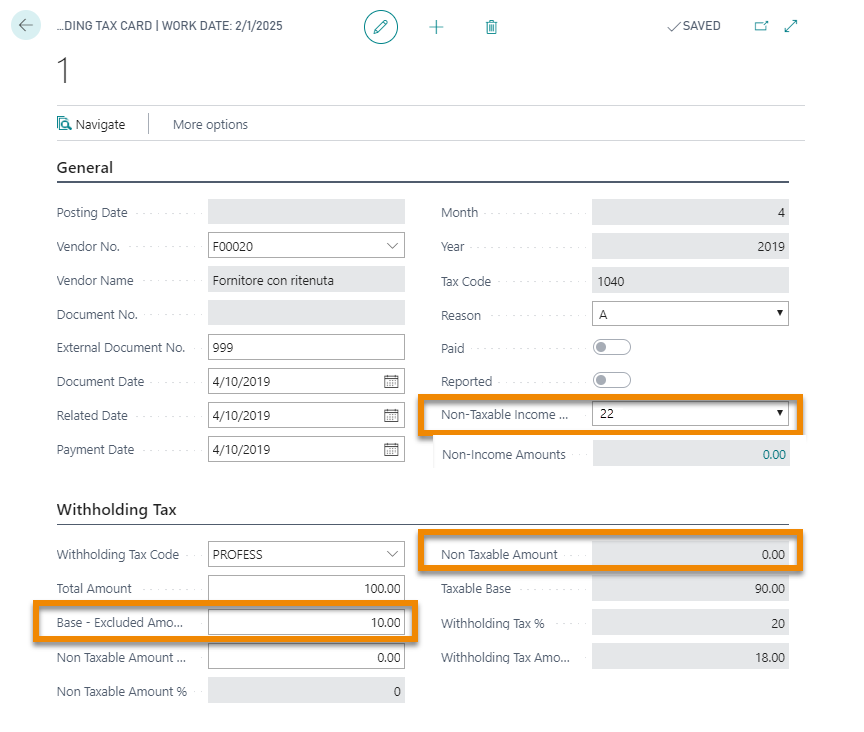

Example 1 - 100% deductible rate

| Field | Description |

| Total Amount | indicate the total amount (e.g. 100,00 €) |

| Base - Excluded Amount |

Specifies the amount of the original purchase that is excluded from

the withholding tax calculation, based on exclusions allowed by law. In the example: 10,00 € (expenses) |

| Non Taxable Amount |

Specifies the amount of the original purchase that is not taxable due to provisions in the law. In the example is equal to zero (100% deductible rate) |

| Non-Taxable Income Type | Extend the standard Non-Taxable Income Type. You need to indicate "22" (22 in case of "Non-Taxable Income") |

| Withholding Tax Amount | 18,00 €: 20% of the taxable base |

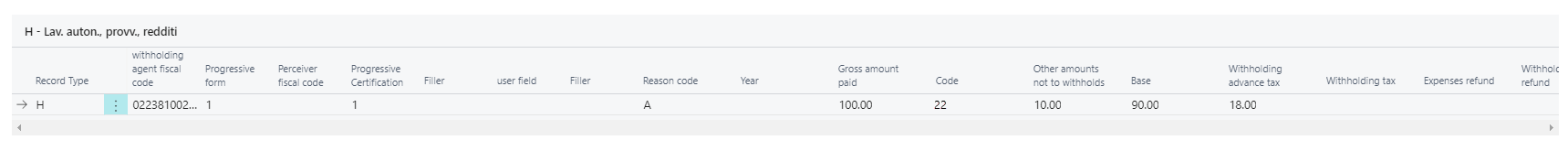

And the PDF preview is:

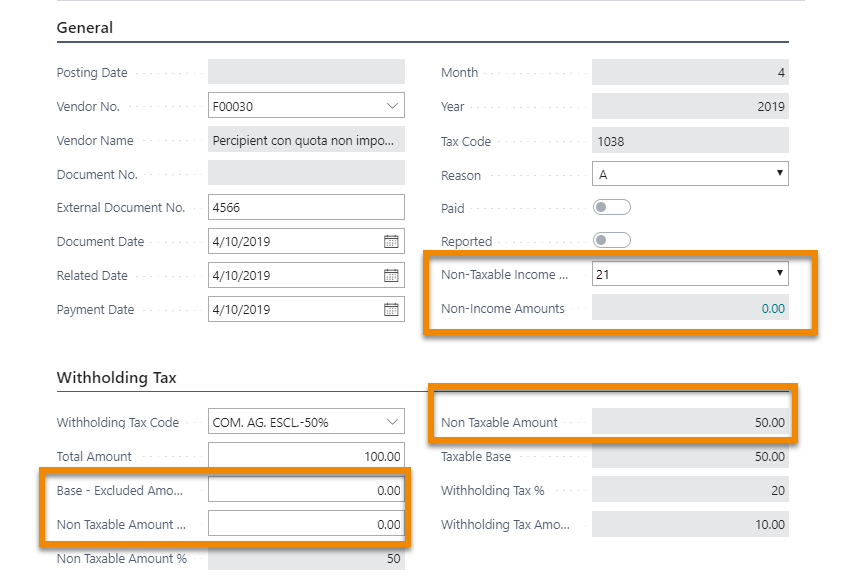

Example 2 - 50% deductible rate (and no expenses refund)

| Field | Description |

| Total Amount | indicate the total amount (e.g. 100,00 €) |

| Base - Excluded Amount |

Specifies the amount of the original purchase that is excluded from

the withholding tax calculation, based on exclusions allowed by law. In the example: 0,00 € (no expenses refund) |

| Non Taxable Amount |

Specifies the amount of the original purchase that is not taxable due to provisions in the law. In the example is equal 50,00 € (50% deductible rate) |

| Non-Taxable Income Type | Extend the standard Non-Taxable Income Type. You need to indicate "21" and fill in the related table in the field below |

| Withholding Tax Amount | 10,00 €: 20% of the taxable base |

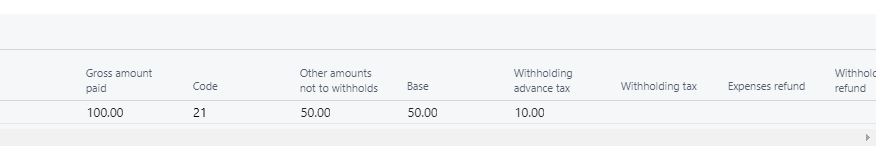

And the PDF preview is:

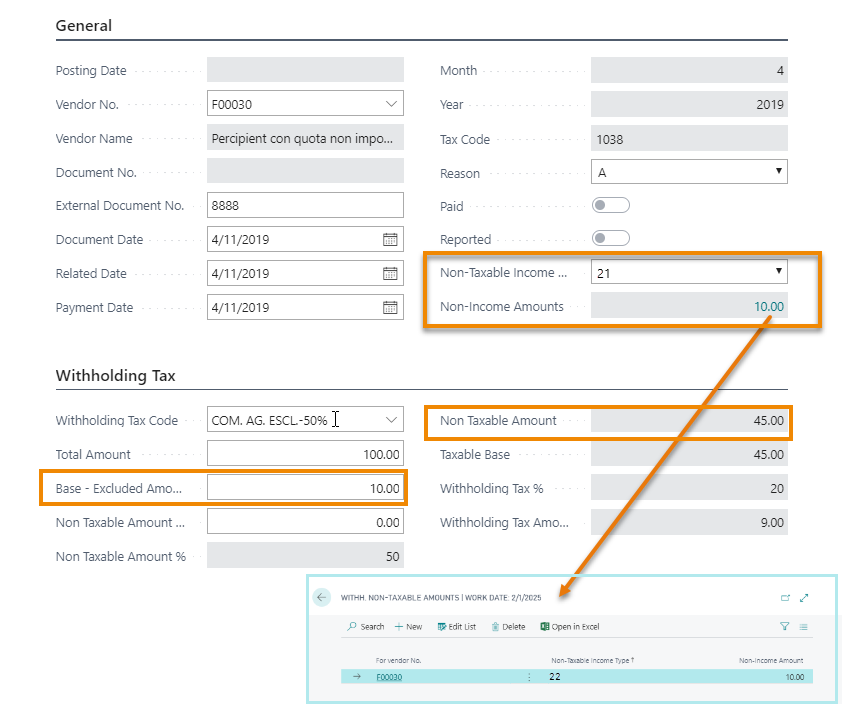

Example 3 - 50% deductible rate (with expenses refund)

| Field | Description |

| Total Amount | indicate the total amount (e.g. 100,00 €) |

| Base - Excluded Amount |

Specifies the amount of the original purchase that is excluded from

the withholding tax calculation, based on exclusions allowed by law. In the example: 10,00 € (expenses refund) |

| Non Taxable Amount |

Specifies the amount of the original purchase that is not taxable due to provisions in the law. In the example is equal 45,00 € (50% deductible rate with the expenses refund of 10,00 €) |

| Non-Taxable Income Type | Extend the standard Non-Taxable Income Type. You need to indicate "21" and fill in the related table in the field below |

| Withholding Tax Amount | 9,00 €: 20% of the taxable base |

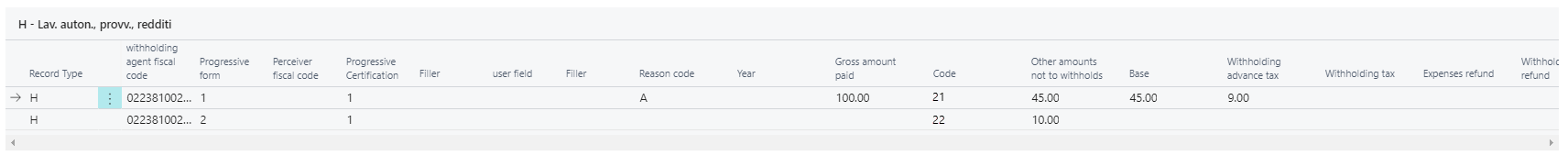

And the PDF preview is:

Print example