Quick guide

- Set the competence dates

- Edit an accrual template

- Post invoices with accruals

- View simulated entries in Chart of Accounts

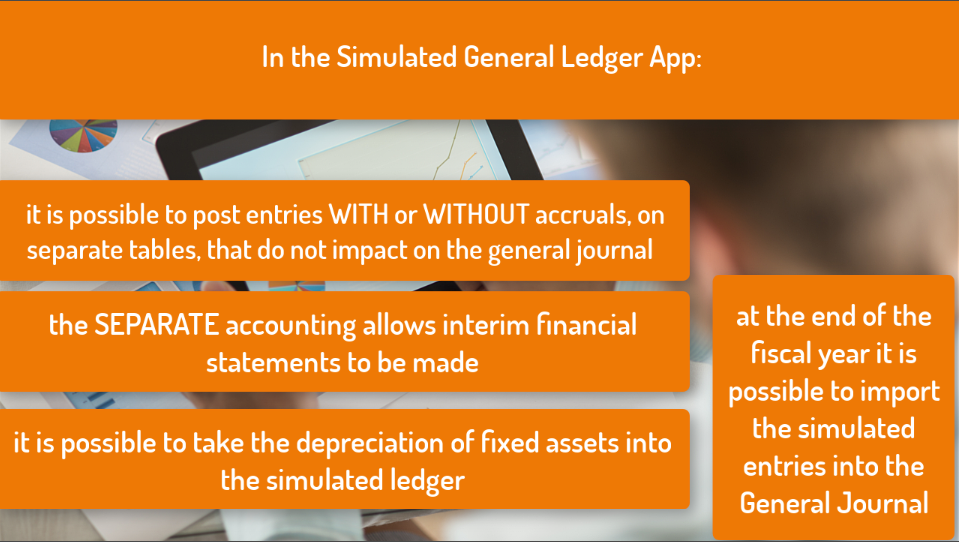

Thanks to the Accruals and Simulated General Ledger App it is possible to post (for both sales and purchase) simulated entries linked to the chart of accounts, but in parallel general ledger accounts. These records have no impact on the general journal and VAT. Normally these simulations are used to generate interim financial statements, because they allow to simulate rectification and closing entries, which otherwise could only be carried out at the end of the year with the closing of the financial year

Moreover, it is possible to manage accruals and deferrals, spreading over the months, quarters, semesters, etc. portions of costs and revenues that have already had an economic-monetary manifestation (deferrals) or that have yet to have economic-monetary expression (accrued). The posting of infra-annual accruals and deferrals takes place using simulated registrations. These entries can be activated at different accounting times:

-

Posted Invoices: by indicating the competence within the posted purchase or sale invoices, the procedure for calculating the C / G sim register is automatically activated relating to the operation.

-

General Journals: indicating the accrual starting and ending date in the posting line. The purchase invoice includes, for each row, the ACCRUAL TEMPLATE fields and the ACCRUAL STARTING / ENDING DATES of the relevant period. The accrual specification in the line allows the insertion of invoices relating to costs / revenues with different periods of competence, but relating to a single economic operation.

-

General Ledger Entries: the "Actions->Functions->Calculate Accruals" button allows generating the simulated entries.

The posting of accruals and deferrals must be balanced and square by single posting date. It is therefore necessary to charge a balance account to compensate the periodic entries generated. This compensation is made up of the Accrued/Deferred income/expense accounts . Once the accounts have been entered in the chart of accounts, they are specified in the dedicated setup: the G/L Accrual Template, in which it is possible to indicate the basis on which to spread costs and revenues, in the case of a monthly calculation, 30 days / month logic or one based on the calculation of actual days.

The Simulated General Ledger app allows you to indicate an unlimited number of templates, but one must be specified by default. The template allows to set:

-

Balance sheets in which accruals and deferrals must be posted.

-

Calculation days / month: that is, if, when you divide a cost / revenue per accrual period, we consider months of 30 days or the number of actual days of each month.

-

Period of competence equivalent to month, quarter, half year or year. This information will be recovered by the system in the calculation of the lines of accruals and deferrals.

Subscription |

|---|

|

Some features of Accruals and Simulated General Ledger For Italy app require a subscription. The subscription can be activated from Subscription control panel or directly from the notification messages that the system proposes, by clicking on the link that allows you to start the subscription wizard. In particular:

See Eos Solutions website for more information. |

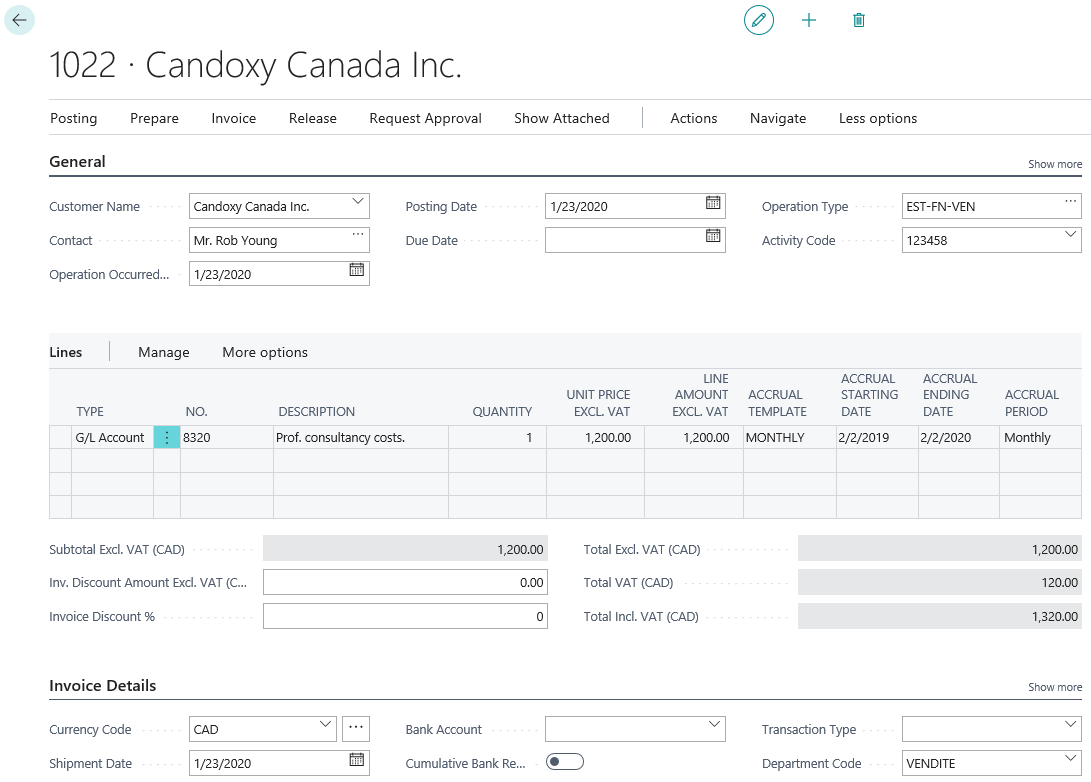

Invoice with accruals

Let's see how the accruals are posted by the system. For example, we make a sales invoice for an annual fee related to consulting services. We choose the template related to accruals and deferrals set in the setup:

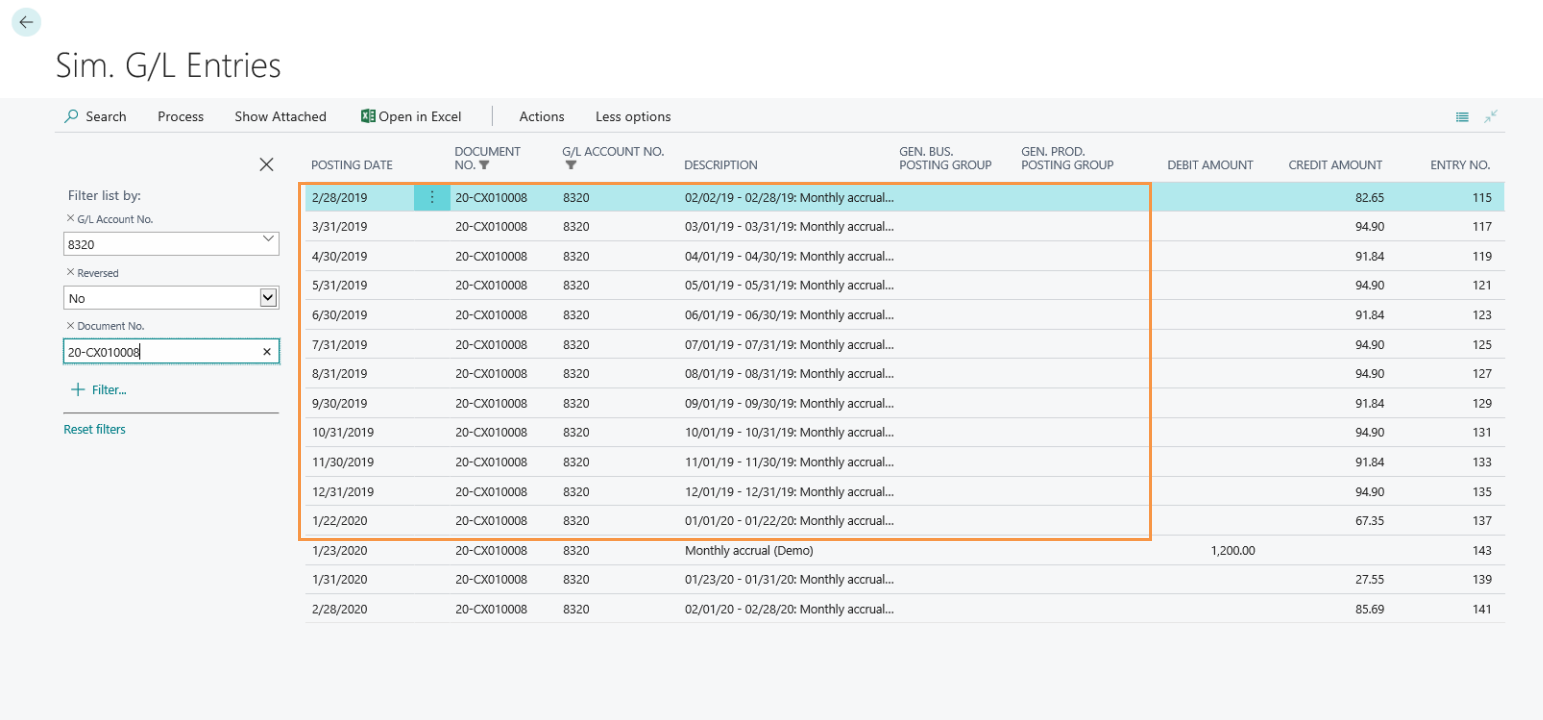

From the Chart of Accounts, Navigate>Account->Sim. Ledger Entries, we can see the simulated posting done by the system.

n Sim. G/L Entries it is possible to view the detailed simulated entries:

The system has created 12 lines, one for each instalment.

NB |

|---|

| The Chart of Accounts also gives you an overview of all ledger entries (with and without period of competence) by drilldown on the column "BALANCE". |

Calculate accruals directly from General ledger entries

It is possible to create accruals directly from General ledger entries without posting an invoice:

Close G/L Accruals

Through the Close G/L Accruals report it is possible, for those who calculate the interim accruals and deferrals with the simulated, to calculate the real balance sheet entries at 31/12 and their relative cancellation.

In General Journal, Functions->Close Accruals:

| Field | Description |

| Ending date | Set the date for the closure |

| Grouping |

Choose to group:

|

| Gen. Journal Template / Gen. Journal Batch | Define a category and a batch for records concerning compensation |

This report performs the following operations

1 . Excludes all movements with:

Registration date, Starting and Ending Competence date less than the date of the report launching: if just one is greater, then the line must be included;

Registration date, Starting and Ending Competence date greater than the date of the report launching: even if only one is smaller, then the line must be included;

2 . At this point, the lines which are included can be defined:

Accrual : if the registration date is greater than the date of the report launching ->the share of the previous year must be added to the current year .

So the Simulated General Ledger app considers all the simulated lines with a date less than or equal to the launch date of the report , adds the amount and creates a GL registration line with the same accounts and amounts;

Deferral: if the registration date is less than or equal to the date of the report launching , -> the share for the following year must be removed from the current year .

So the Simulated General Ledger app considers all the simulated lines with a date greater than the launch date of the report, adds the amount and creates a GL registration line with the same accounts, but with inverted amounts.

The report carries out the posting on the 1st of January in the G/L entries and the relative cancellation in the simulated entries automatically calculated.

In General Journals, the "Balance in Simulation" flag is visible on the lines. When set, lines are posted 1:1 with a reverse sign in simulated.

Calculate Depreciation

The depreciation entries relating to the assets can be performed using the report in General journals->Actions-> Functions> Calculate Depreciation:

Block Accrual Posting

For the purposes of automatic calculation of accruals and deferrals, it is possible to block accrual posting. If during the accrual calculation the accounting period (month) is closed, the share of the period is accumulated over the following period. In this way it is possible to preserve accounting situations already closed for accounting / statistical purposes.

Account schedules

The Account Schedules show numbers aggregated according to a previous setup (you can define columns , formulas and the ranges to be aggregated in the chart of accounts).

it is possible to have an overview of the G/L entries + G/L sim. entries and to generate interim financial statements.

And then, by drilldown you can see the detailed view of the Chart of Accounts

SETUP

Template

In G/L Accrual Templates:

set:

|

Field |

Description |

|---|---|

| CODE | Decide a code |

| DESCRIPTION | Choose a code description |

| INCOME ACCRUAL ACCOUNT | Set an account number for income accruals |

| DEFERRED INCOME ACCOUNT | Set an account number for deferred income |

| PAYMENT ACCRUAL ACCOUNT | Set an account number for payment accrual |

| PREPAYMENT ACCOUNT | Set an account number for prepayment |

| DAYS PER MONTH |

Indicate the basis on which to spread costs and revenues, in the case of a monthly calculation, 30 days / month logic or one based on the calculation of actual days. Options:

|

| TYPE |

Decide if the template is for real or simulated ledger:

|

| PERIOD TYPE | Period of competence equivalent to month, quarter, half year or year. |

| ACCRUAL DESCRIPTION SOURCE | Choose whether the description should be taken from the line, from the posting or if it should be a fixed description. |

| POSTING DESCRIPTION | Specify the description if you have chosen the "Fixed Description" option in the "Accrual description source" field |

| ALLOW G/L ENTRY GROUPING | The system tries to group the entries as much as possible, "before" competence calculation. This can be useful, for example, if you want to change the calculation of the competence of a single line of a document ex-post, or when the calculations of competence are many and you want to avoid posting lots of records. |

|

|---|

In the Competence Dates Setup

set the possible registration time intervals: In G/L Account Card enable "Allow Sim. Posting" (you can enable this option if "Direct Posting" is off).  |

Document to Receive / invoice

It may happen that at the end of the month, at the time when many companies make the monthly balance sheet, or at the end of the year when you have to close the official balance sheet in Real Accounting, you need to make the registration relating to the invoices and credit memos to be received.

The functionality regarding invoices to be received / issued is also part of the Simulated General Ledger (SGL) app.

See the details here.