1. Reporting file import

2. Creation of bank statements

3. Bank transactions connection

5. Bank account reconciliation

6. Bank statement posting - Closing of bank entries

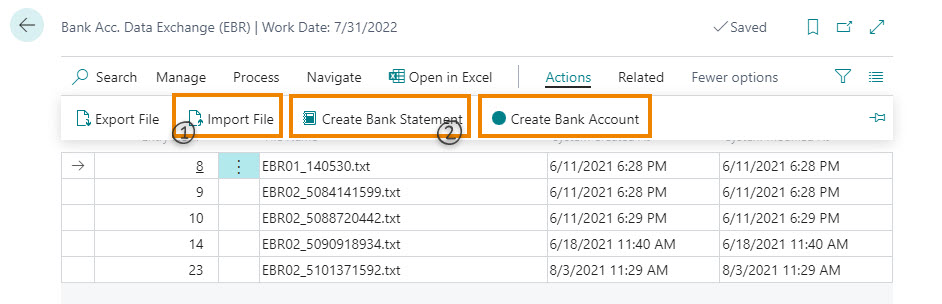

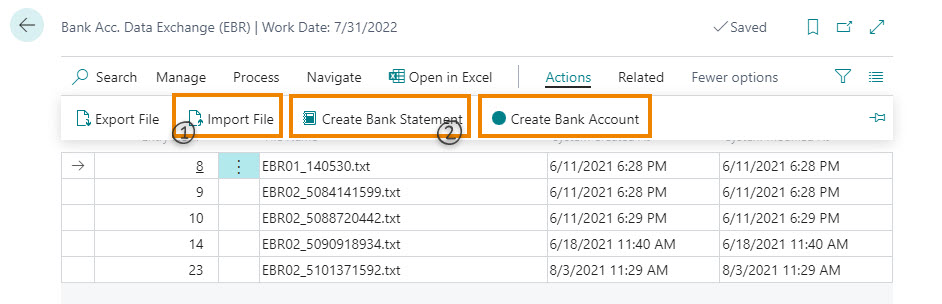

1. Reporting file import

It is possible to import the reporting files from the "Bank Acc. Data Exchange (EBR) " page using the " Import file" function (1).

The system performs a consistency check, verifying that:

-

the file comes from an authorized banking group (via SIA code)

-

the file has not already been imported

-

the bank is present and correctly set in the system

There is a Log function that exposes any errors in importing and creating the bank statement.

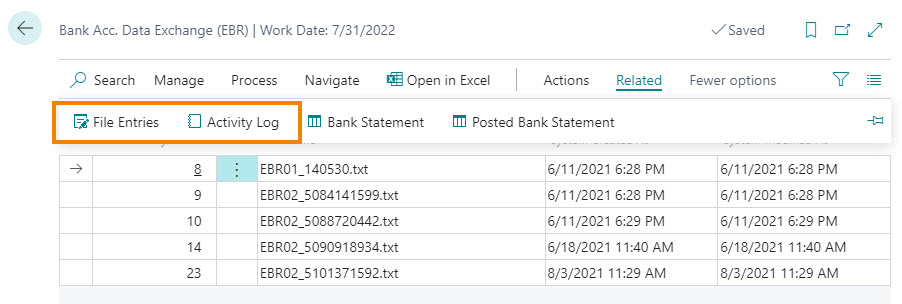

After importing the file, you can check the Activity Log or view the imported transactions (File Entries):

It is possible to create the bank statements associated with the imported file using the " Create bank statement" function (2).

The Create Bank Statement function will propose any current accounts to be created in order to import the file (these accounts must be qualified in the master data before proceeding).

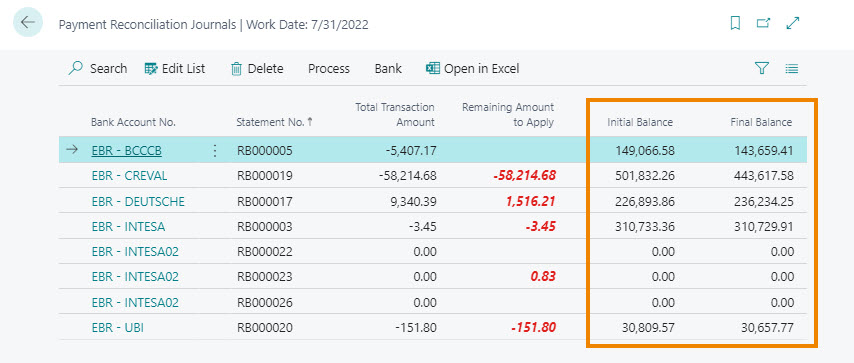

3. Bank transactions connection

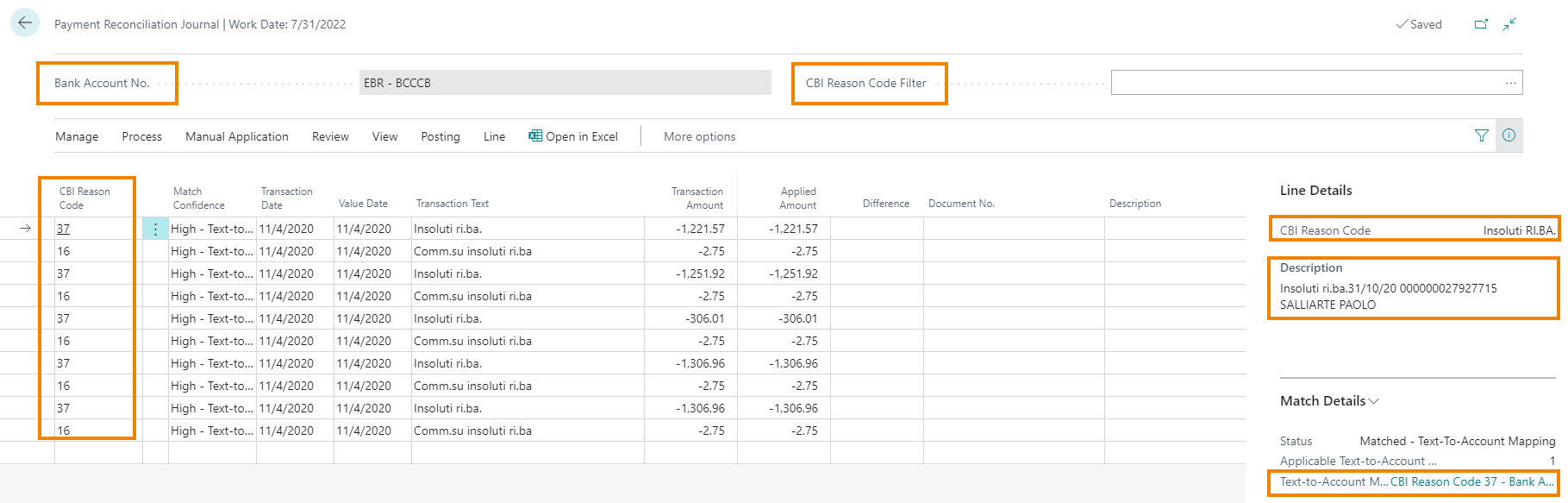

The page "Payment Reconciliation Journal" contains various information (including the CBI Reason and the ability to view all the data of the bank transaction)

In the reporting form, the movements will be recognized through the automatic or manual connection procedure.

-

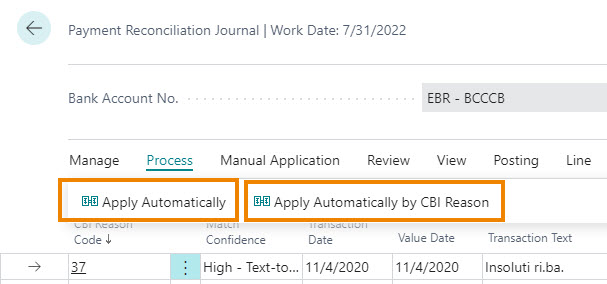

The standard linking procedure has been modified to manage linking by CBI reason

-

A new procedure "Apply Automatically" has been integrated, which can be performed on record sets (which is not possible with the standard procedure that always recalculates all links in the report)

The main types of operations that can be managed are the following:

-

Automatic G / L account proposal relating to financial charges / income

-

Bank-to-bank transfer funds

-

Automatic proposal for transit account (cash pooling, transit for receipts \ payments recognition)

-

Link to bank transactions already accounted for (e.g. payments by bill)

-

Connection Receipts \ payments with batch balance

-

Differences management with posting on specific accounts

-

It is possible to post the statement only if all the movements have been "linked"

-

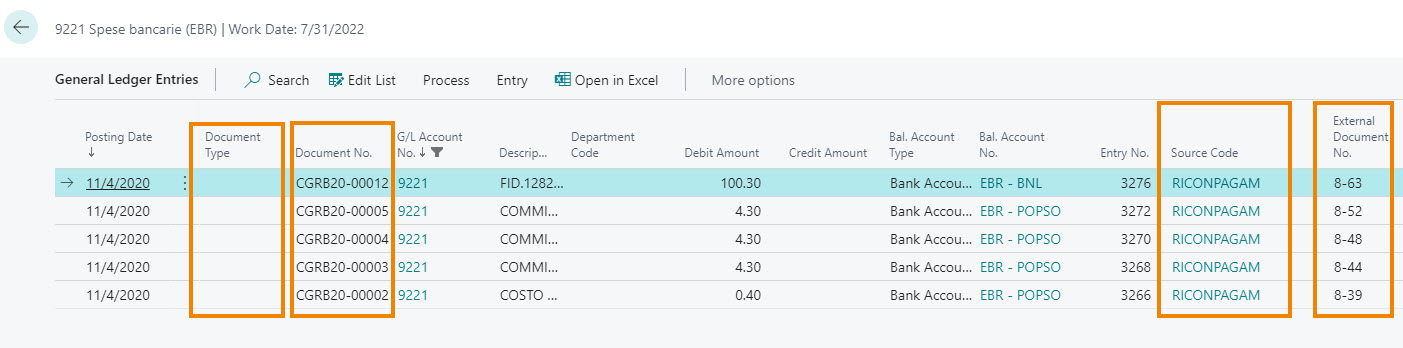

For each bank transaction, the system carries out a double-entry posting with the recognized account as a counterpart and assigning a specific Document No. defined in the "Posted Reconc. Ledger Entry Nos." field of the bank account.

(Unlike the standard functionality that assigns the same document number to the entire statement even if the transactions have different dates).

-

If the movement is combined with an already accounted bank movement, the system does not carry out further transactions, but "links" the movement.

-

It is possible to manage the "Document type" according to the CBI reasons.

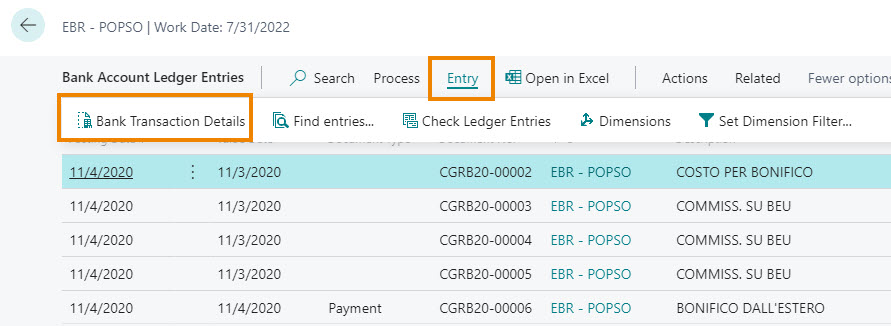

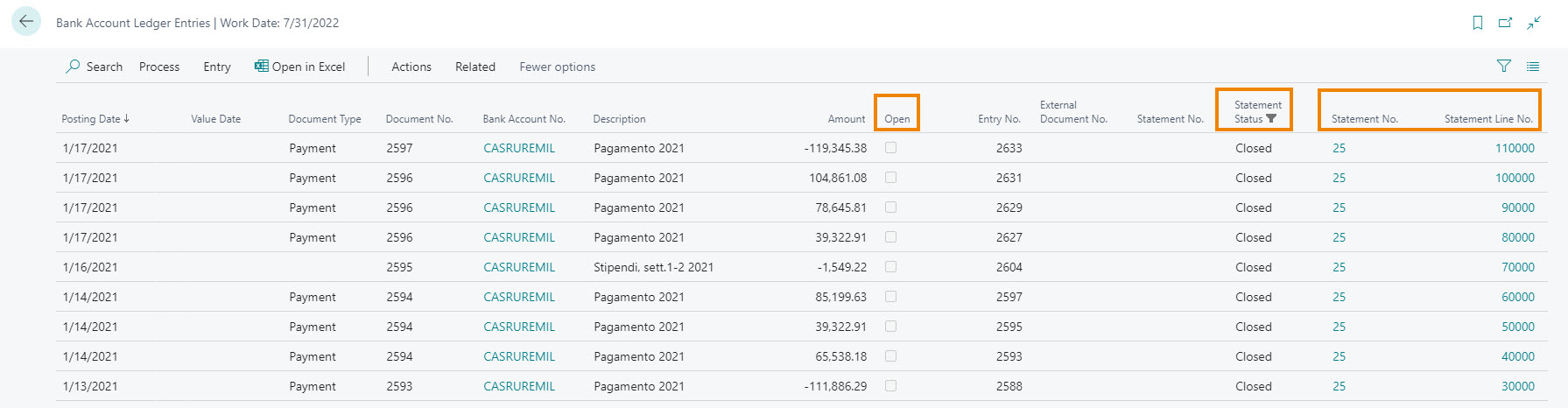

On bank accountancy movements

-

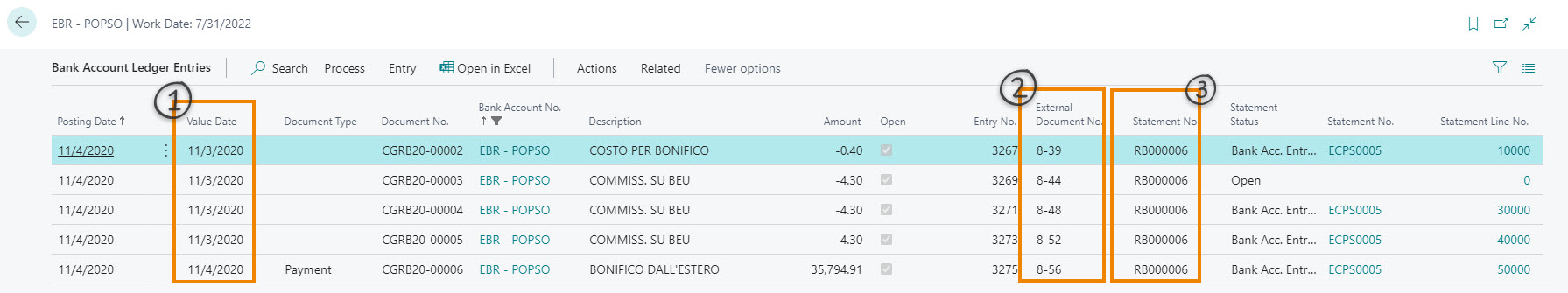

The value date is visible (1)

-

Each movement reports the number of the statement from which it originated (2)

-

The single transaction is always referenced in the "External document number" (3)

It is always possible to trace all the information of the bank transaction from the bank account ledger entries or from the G/L entries. This allows the reconciliation and matching of entries in the case of use of transitory accounts for the recognition of receipts and / or payments

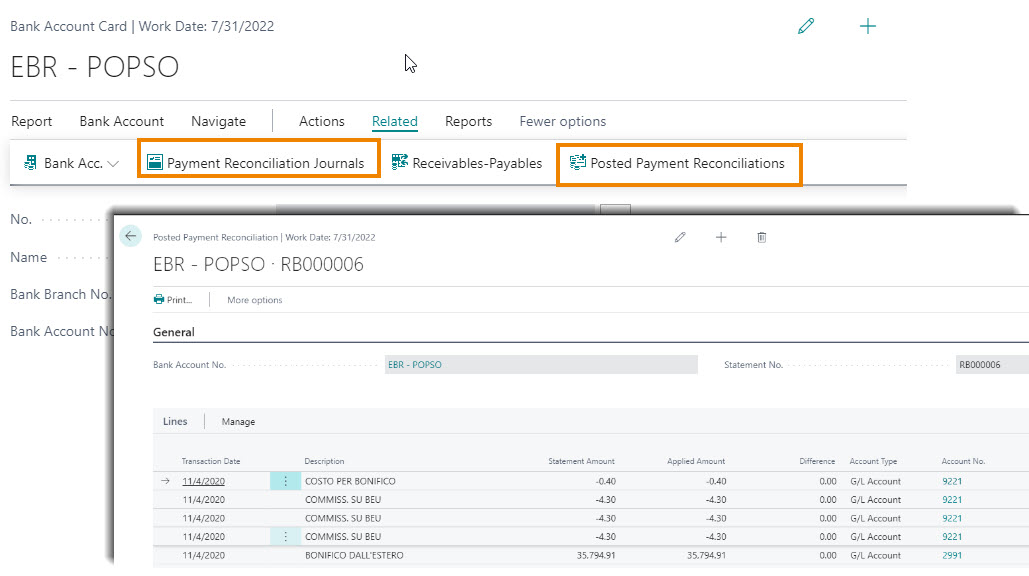

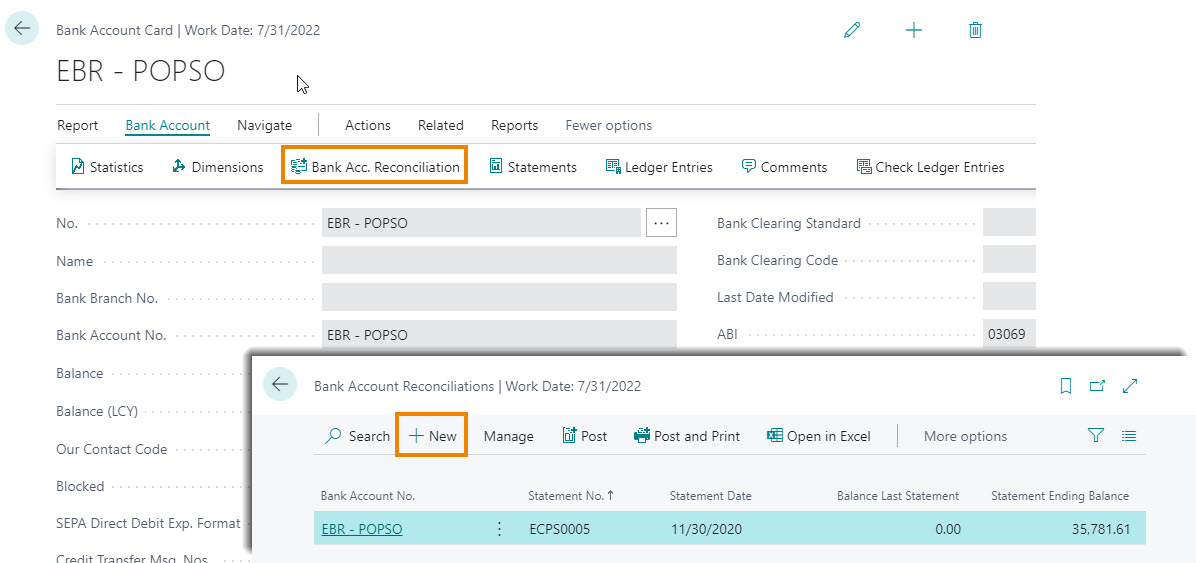

Bank account card - Access to bank statements

From the bank account card, it is possible to quickly access the Statements to be posted ("Payment Reconciliation Journls") and the posted Statements (Posted Payment Reconciliations).

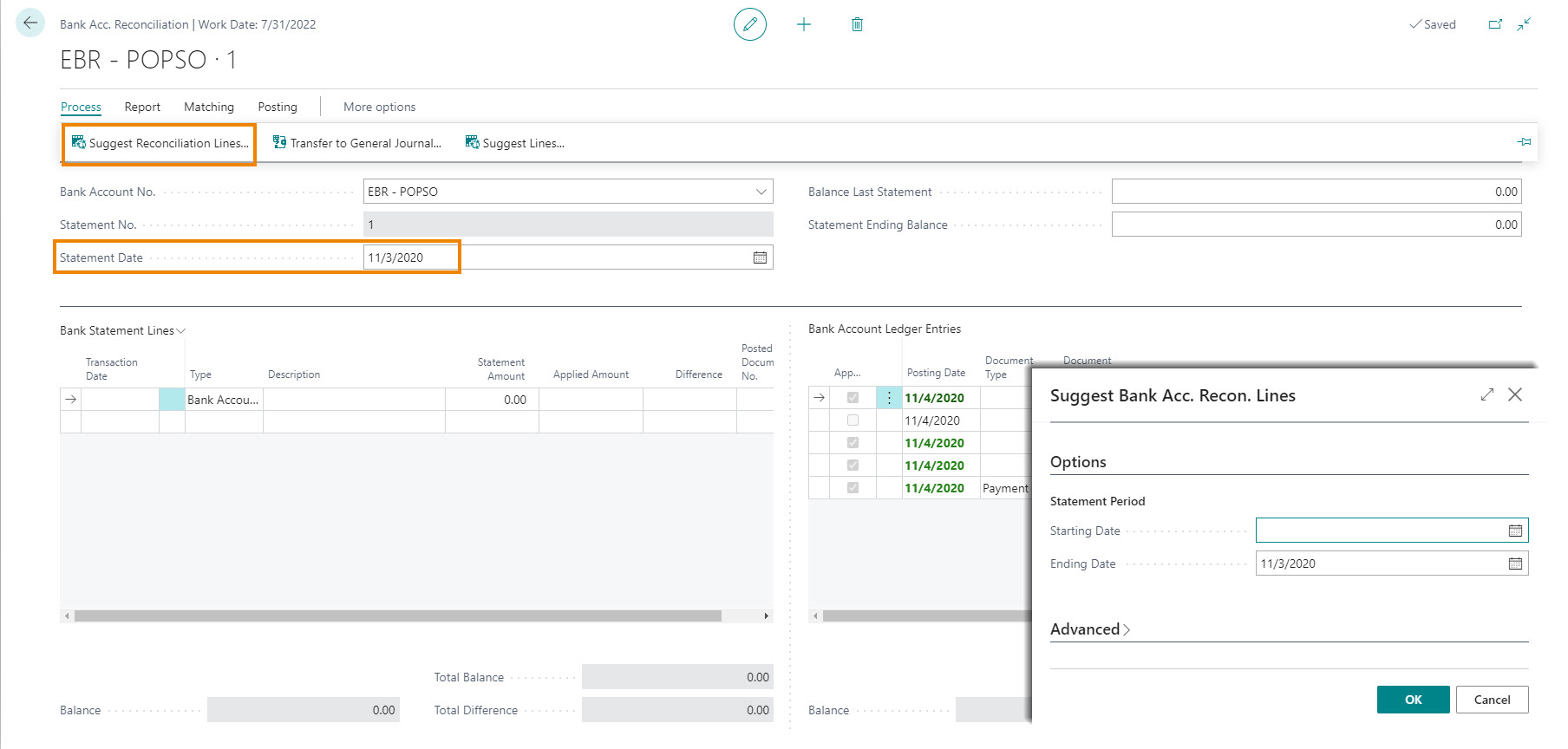

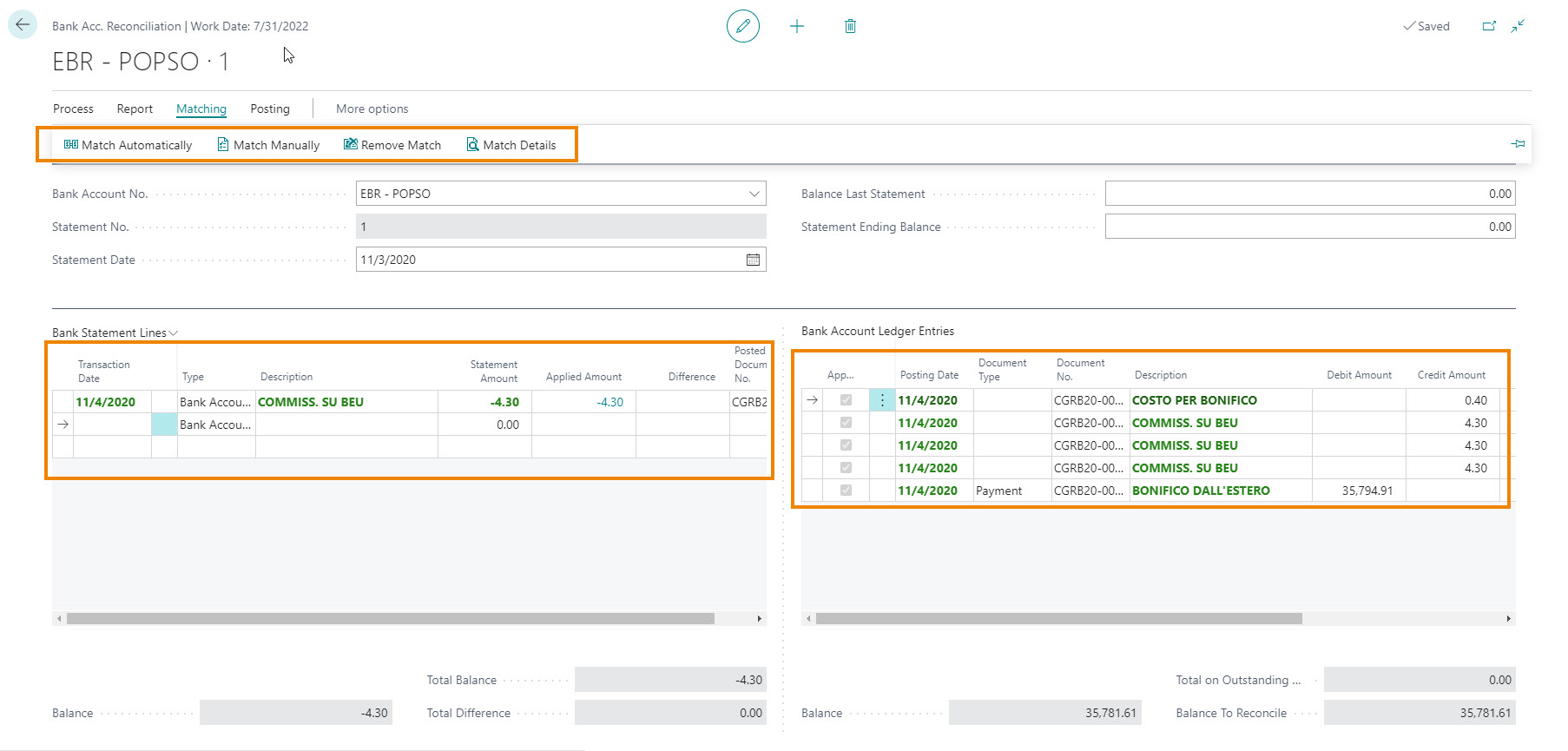

5. Bank account reconciliation

The account statement allows the suggestion from the "Posted Payment Reconciliations" by performing the automatic reconciliation. It is possible to access the "Bank Acc. Reconciliation" directly from the bank account card.

By pressing New and then using "Suggest Reconciliation Lines" the system suggests the lines from the posted bank statements (Posted Payment Reconciliations):

Bank statement / reconciliation of entries

During the suggestion phase, the system will make an automatic match with bank transactions. However, it is possible to intervene with the standard connection / disconnection functions

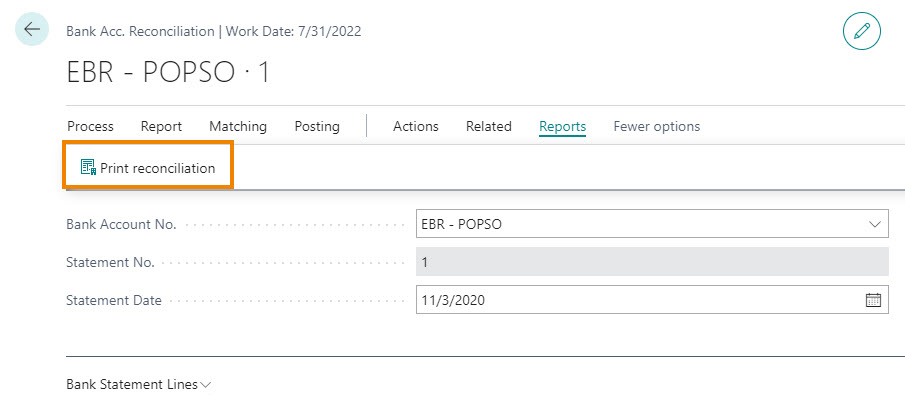

Account statement \ print reconciliation

There is a specific reconciliation printout which highlights the

entries not linked

6. Bank statement posting - Closing of bank entries

The posting of the bank statement "closes" the bank transactions (the reference to the posted bank statement is always present on the bank transactions).

Starting from BC18, the posting of the bank statement can be undone.

The posted bank statement can be printed by standard EC printing.

See also: