Intrastat Declarations (ITR)

Go to page Intrastat Declarations (ITR). Here you can access the previously entered communications or create new ones. To generate a new declaration press "New."

| Field | Description |

| No. | It is filled with the sequence number set in the setup that corresponds to the file number sent |

| Type | Choose between Sales / Purchase side. (Both Sales and Purchase contain all the sections to fill in) |

| Teclaration Type | The type of declaration in the header is reported in lines. It can be modified for each line |

| Year | Enter the reference year (4 digits) |

| Periodicity | Choose the periodicity "monthly" or "quarterly" |

| Period | Enter the period (for example, on a monthly basis: 5 = May, on a quarterly basis: 2 = second quarter) |

| Creation | Date and time filled in automatically by the system |

| Total Amount (LCY) | Total amount of the Declaration |

| No. Printed | It is kept the count of copies already printed |

| Intraweb Export Date | The field is filled in automatically by the system |

| Status | A declaration just entered is in "New" status. From Process-> Release you can pass it in the state "Released" |

| Simplified Mode | Enable the option if you want to make use of the simplified procedures |

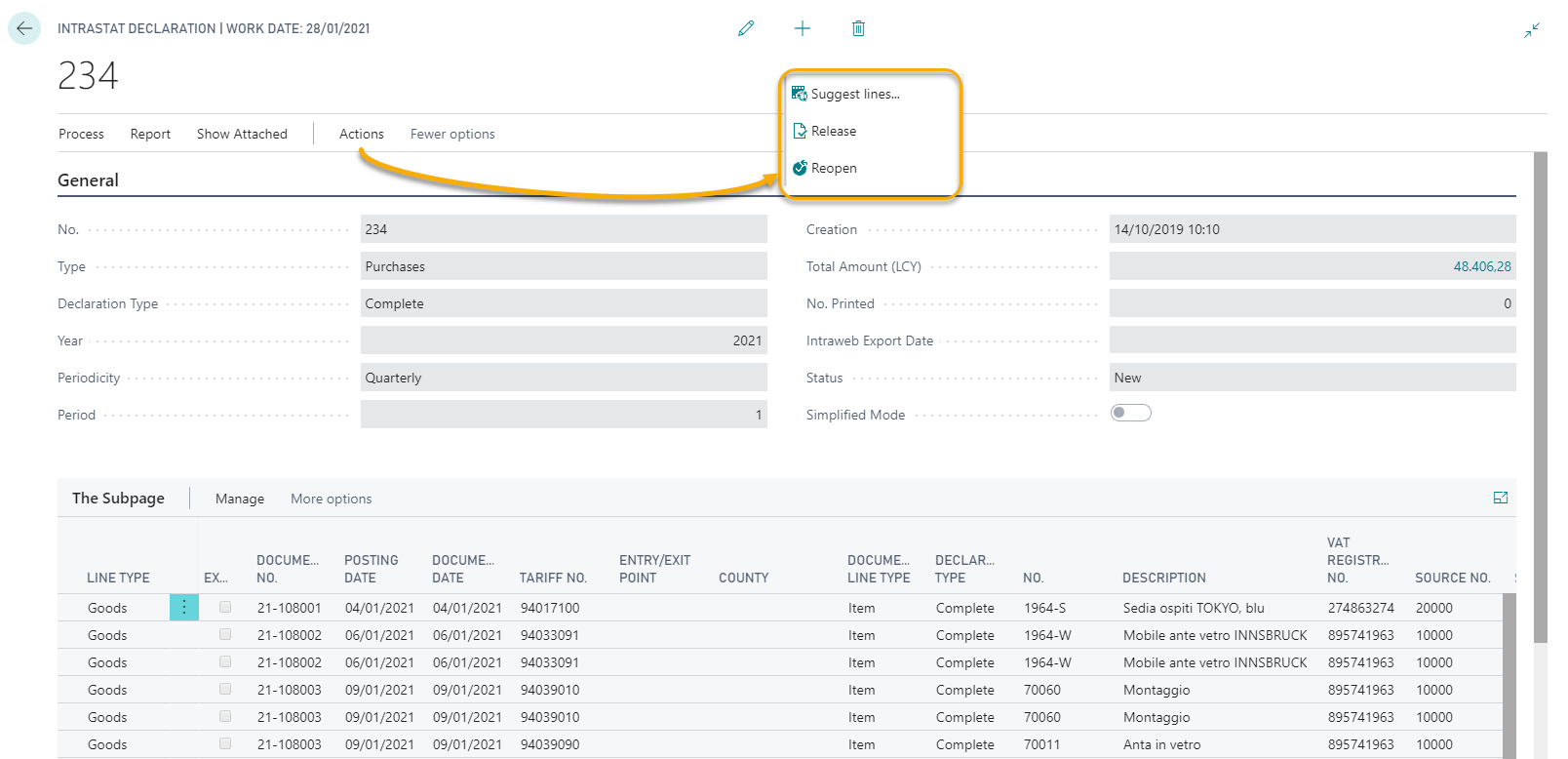

The lines of the Declaration can be written manually (Manage-> New line), or you can retrieve lines from shipments -> Functions-> Suggest lines. With this function, the lines are automatically proposed. The user has the option to change all values and to delete or add lines.

By choosing "Suggest lines" you can set a "percentage cost adjustment" filter by various fields, including the document number.

When finished, the status of the declaration may be passed in "Released" by Actions-> Functions-> Release. If all fields are filled in correctly, once issued the declaration can be printed and the file can be generated.

|

|---|

|

A released declaration can be modified by Actions-> Functions-> Reopen. |

The system performs checks on the fields "ServiceTariff Numbers", "Transaction Type", "VAT Number", "Supply Method", "Payment Method Code" and "Payment Country" (which can be pre-compiled in the Intrastat Defaults and in Invoices) before passing the declaration in "Released" status.

|

|---|

|

In the case of Purchase lines, the value of the Payment Country Code is taken from the "Bill To- Country Code" for the purchase invoice header or, possibly, from the vendor bank; in the case of Sales lines, this value is proposed based on the value of the "Country/Region Code" on the page "Company Information". |

Print / export the communication

To print the communication press Actions-> Print:

| Action | Description |

| it is the detailed printing of the records contained in the sections (1, 2, 3 and 4) in the scambi.cee file, which are combined according to the logic established by the Agenzia delle Dogane. | |

| Cover | it is the printing of the cover page and exposes some summary data of the various sections (1, 2, 3 and 4) present in the scambi.cee file. |

| Export file | this action creates the scambi.cee file for Intrastat Purchase / Sales declaration, from which it is executed. |

Print example

See also:

Advanced Intrastat For Italy - Introduction

Advanced Intrastat For Italy - Setup